The music business is kind of bored. Outside of the churn of big-money catalog acquisitions and enthusiasts wibbling on about the potential of Clubhouse and NFTs, the industry (like many of us?) is in an oddly inert place right now.

A big part of that is, obviously, the omission of live concerts, plus the relative quiet of the major record companies. With a few notable exceptions — Taylor Swift and BTS, for example — think of the superstar albums we haven’t seen in the pandemic: Adele, Kendrick Lamar, Bruno Mars, Ed Sheeran, Cardi B, Drake, Kanye, Travis Scott, Rihanna, and many more, all MIA. No wonder the world’s biggest music rights companies saw bottom-line profits soar in 2020; their spending presumably decreased. Perhaps, though, this is the calm before the storm.

The biggest music business story of several years is waiting in the wings, and it could be even more climactic than anticipated. Last month, Universal Music Group (UMG) parent company Vivendi confirmed that its management board was considering a proposal to “spin out” 60% of the world’s biggest music company onto the Amsterdam Stock Exchange at an undefined point in 2021. A final decision — spoiler: it’s going to be a big “yes” — is due by the end of this month. But what valuation will Universal reach as a public company?

So far, the answer to this question has largely been informed by the recent acquisition of 20% in UMG, via two installments, by a consortium led by Tencent. That acquisition gave UMG a €30 billion ($36 billion) enterprise value as recently as January. Vivendi says this qualified as the “minimum target” valuation it needed to trigger thoughts of going public in Amsterdam.

Some think Tencent got an absolute bargain. Daniel Kerven, JP Morgan Cazenove’s Head of European Media and Internet Equity Research, hit headlines in February 2019 by suggesting that Universal Music Group was worth over €44 billion ($50 billion). This, he said, was due to UMG’s “undermonetized, must-have, global content that is strategic to the tech giants and can’t be replicated.” Kerven was notably more bullish on UMG than other analysts at the time, including Morgan Stanley, who estimated UMG might be worth somewhere between $29 billion and $42 billion.

Two years on, streaming revenues have continued to mushroom, even through a pandemic, and the valuations slapped on Universal have grown in tandem. In a research note earlier this month, Morgan Stanley analysts Omar Sheikh and Patrick Wellington suggested that UMG could now carry a “fair value” worth of around $49 billion. That’s approximately a 29-times multiple on UMG’s EBITDA profit in 2020 ($1.7 billion), and 23-times the EBITDA that Morgan Stanley estimates that Universal will post in 2021.

Once again, though, Daniel Kerven has trumped all-comers. In a research note issued last month, Kerven pointed out that he had long maintained UMG’s value was higher than €40 billion, but that he was now ready to go one further. “[We] have suggested a blue sky valuation of €100 billion,” wrote Kerven of UMG. That’s equivalent to nearly $120 billion, and three times the valuation cemented by the Tencent consortium stake sale.

Kerven’s super-positive valuation of Universal was largely supported by his belief in the potential for “billions of [music streaming] subscribers” worldwide — we’re currently at about 450 million — as well as future “price rises” by streaming services like Spotify “supported by innovation.”

Kerven also pointed to the “first time monetization of emerging markets” by streaming services (as demonstrated by Spotify’s recent expansion into over 80 new territories) as well as the potential for UMG to earn more money from the use of its music in social media and fitness applications (as noted in this column in December). More generally, Kerven pointed to “a potential convergence premium, given music’s ability to drive traffic, engagement and support much bigger and more valuable ecosystems.” In other words, whatever the next iPhone, Facebook or TikTok might be, it’s going to need music — and it’s going to need to pay Universal in order to use it.

In the interest of balance, there is a more bearish case to be made on Universal’s valuation today. To name a few future risk factors for the company:

1. The rise of the DIY artist sector, which — by sheer volume — is now nibbling into the overall streaming market share of the three major record companies. Compounding this trend is the expansion of Spotify and others into territories where local independent labels, like YouTube giant T-Series in India, have a bigger local presence than one or more of the majors. No wonder Som Livre, Brazil’s biggest domestic label, is believed to be close to selling up for around $300 million. Don’t be shocked to see a major music company swoop.

2. Universal’s labels are now signing more generous deals with superstar artists like Taylor Swift than ever before. Whether it’s services-type contracts or a short-term licensing deals, these agreements can see full control of copyrights return to artists within a handful of years, while more than 50% of royalties are paid to them in the meantime. The more miserly “in perpetuity” rights deals the majors signed in the past are (thankfully) becoming a relic of a bygone age, a transition which will likely impact UMG’s margins in the future.

3. Artist/songwriter agreements with music publishers today expire with relative regularity. In addition, veteran songwriters can apply for the termination of their publishing copyrights in the US, whatever their deals might be, 56 years after their songs were released ((see: Paul McCartney’s battle with Sony Music Publishing a few years back). Such trends mean more copyrights leaving the grasp of major music companies, and subsequently being acquired by well-funded, catalog-snaffling upstarts like Hipgnosis Songs Fund and Primary Wave. Universal, of course, recently laid down the hammer on this narrative by buying Bob Dylan’s song catalog for as much as $400 million.

All of that said, Universal’s sheer heavyweight power in the music industry — with a 30%-plus global market share of total recorded music revenues — plus its almighty owned catalog will be the primary factor fuelling investor confidence in its spin-out, and its ultimate valuation.

On that topic, one senior and fiscally focused industry insider passed me a set of rough numbers the other day that further adds weight to Universal’s potential of becoming a $100-billion-plus company in the months and years ahead. And it’s all down to Spotify’s market cap, which currently stands at $51.8 billion.

In this exec’s words: “If Spotify investors expect a standard 7% yield from their investment [as per that market cap], they would also expect the company to be generating $3.6 billion in annual profits. But with annual costs of around $2 billion, Spotify is currently operating at close to break-even. If we assume for sake of argument that Spotify is able to grow without increasing its costs, it would have to generate $5.6 billion in gross margin to deliver those $3.6 billion in profits.

“With a gross percentage margin of 25%, to deliver $5.6 billion, Spotify would need to generate annual revenue of $22.4 billion, which in turn would pay the record industry $11.6 billion, based on the net revenue share of 52% that Spotify gives the major record companies.”

He continued: “Now, if we assume that Spotify has a 35%-ish market share, the total music streaming market’s annual payouts to the record industry would have to reach $33.1 billion for these projections to make sense. Yet the entire global record business earned $11.4 billion from streaming in 2019. Therefore, Spotify’s current valuation implies that the record industry’s streaming revenues will near enough triple in the future.”

Now that’s music to Universal’s — and its prospective investors’ — ears.

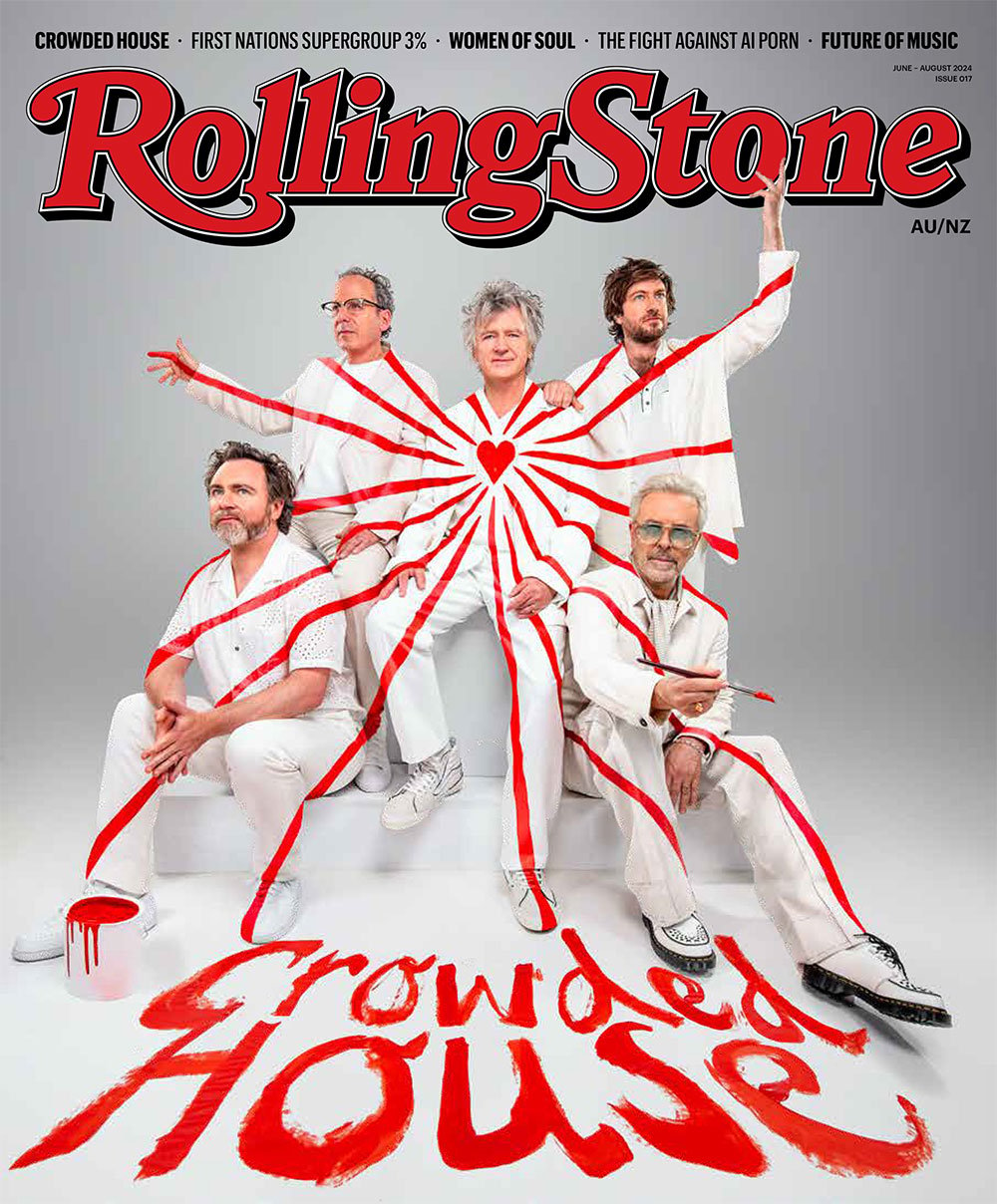

Tim Ingham is the founder and publisher of Music Business Worldwide, which has serviced the global industry with news, analysis, and jobs since 2015. He writes a regular column for Rolling Stone.

From Rolling Stone US