The New York Times has obtained tax-return data for President Trump that shows he paid no income taxes in 11 of the 18 years the paper examined. The bombshell report also revealed that Trump paid only $750 in federal income taxes in 2016, the year he won the presidency. And he paid the same amount in 2017, his first year in office.

Trump, who has refused to release his tax returns on multiple occasions, using the excuse that he has been under IRS audit, called the report “fake news” during a Sunday news conference.

But the Times says they have obtained more than two decades’ worth of tax-return data for Trump and for hundreds of companies in his business organization. The president’s debt that, according to the report, he has personally guaranteed is in the hundreds of millions of dollars is coming due in the next four years. The Times says that debt leaves Trump dependent on his business accumulating more income, which is a conflict of interest with his duties as president.

How has the president secured such a low tax bill? He reports his businesses as losing income year after year. The report from the Times says that Trump’s tax returns “portray a businessman who takes in hundreds of millions of dollars a year yet racks up chronic losses that he aggressively employs to avoid paying taxes.” Trump also deducts a lot of expenses, including deductions for his mansions, $70,000 in hairstyling costs and a criminal defense lawyer. And he once paid his daughter, Ivanka, $747,622 in “consulting fees” while she worked for the Trump Organization, which also reduced his tax debt.Trump’s attorney disputed the report as “inaccurate” and claimed that Trump has “paid tens of millions of dollars in personal taxes to the federal government.” But the Times says the lawyer is conflating federal taxes such as social security and Medicare that Trump pays for employees with Trump’s income taxes.

This report mostly confirms what many have suspected for a while. After all, following the Times’ reporting on Trump’s 1995 tax information during the 2016 campaign, Trump admitted he reports business losses to reduce his tax bill. “Of course I do. Of course I do,” he said at the time. But to see the full scale of it reported like this is a sobering reminder that every dollar Trump cheated the government is a dollar that could have gone toward education or social programs.

Because this isn’t just typical tax avoidance by the wealthy. Even compared to his peers, Trump paid remarkably less. As the paper points out, the average taxpayer in the top .001% of American earners paid an effective rate of 24.1 percent — much more than Trump’s measly $750. If Trump had been paying the average amount of taxes as his wealthy peers, he would have paid the government an additional $400 million each year, according to the Times.

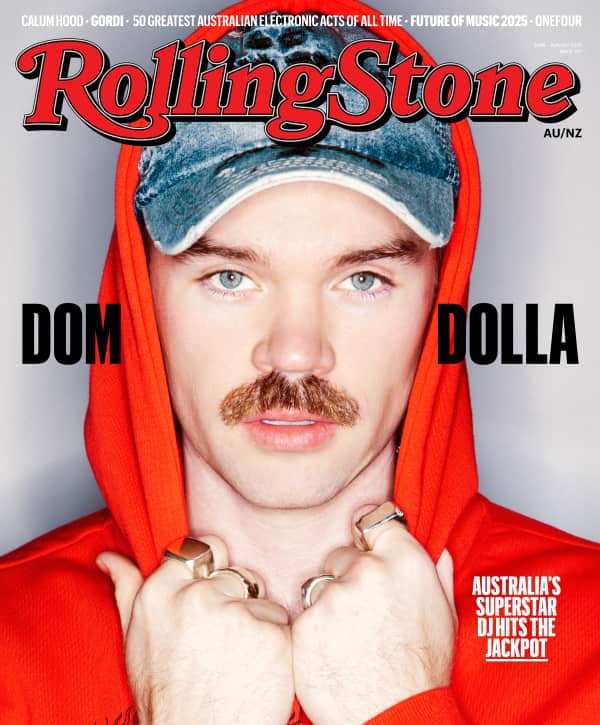

From Rolling Stone US

Love Music?

Get your daily dose of everything happening in Australian/New Zealand music and globally.