“I’ve never signed anything with a ‘T’ before,” Donald Trump quipped at the signing of the $2 trillion CARES Act. He reportedly wants his signature on coronavirus relief checks, as if they were Trump Plaza casino chips. This might be a fitting metaphor for America’s post-virus economic future.

The new bailout bill, which combined with a series of Federal Reserve interventions is more like a $6 trillion rescue, is a massive double-down on the 2008 rescue efforts. This bailout of the last bailout sets the stage for permanent state sponsorship of America’s overheated financial markets.

Like 2008, only moreso, the new mega-rescue is a bipartisan effort. Lawamkers sold this as a good thing.

“This is a 9/11 moment,” said Republican congressman Dan Newhouse of Washington state. “A time to put partisan differences aside.”

“We have our differences, but we also know what is important to us,” said House Speaker Nancy Pelosi. “America’s families are important to us.”

Congress needed a year of intense infighting to approve a $4.7 trillion budget, but just a single week to draft this $2 trillion deal. Although members quibbled before the vote over numbers — Bernie Sanders insisted on more unemployment insurance, while others worried about creating a “slush fund” for airlines and other industries — the bill ultimately cruised through, passing in a voice vote in the House and 96-0 in the Senate.

The Emergency Economic Stabilization Act of 2008, the only comparable “We need a gazillion dollars in ten minutes” legislation in recent history, passed after a bitter battle, with 63 House Democrats and 91 House Republicans opposing.

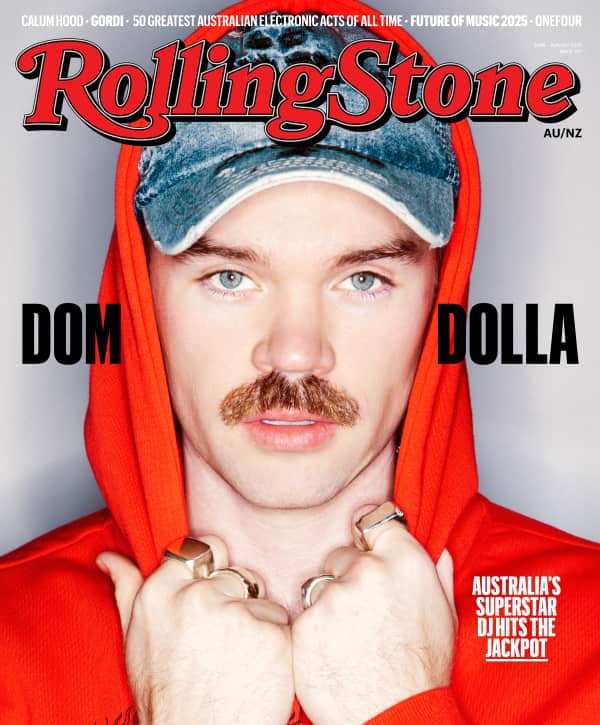

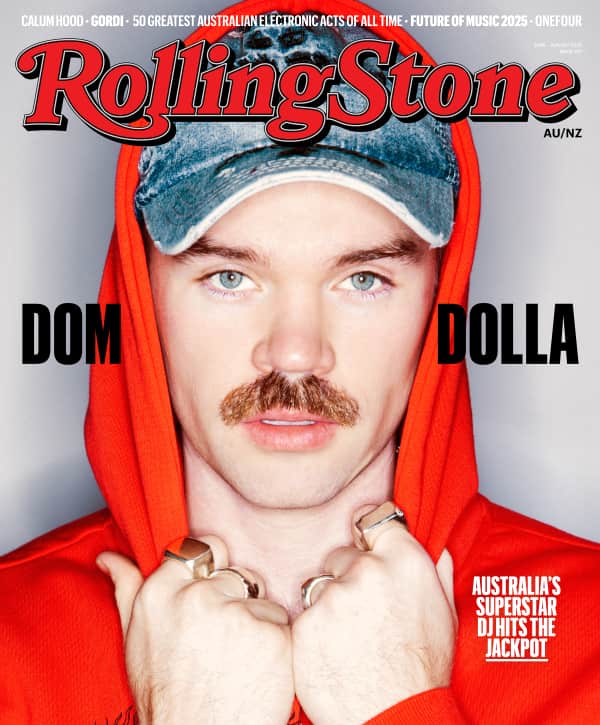

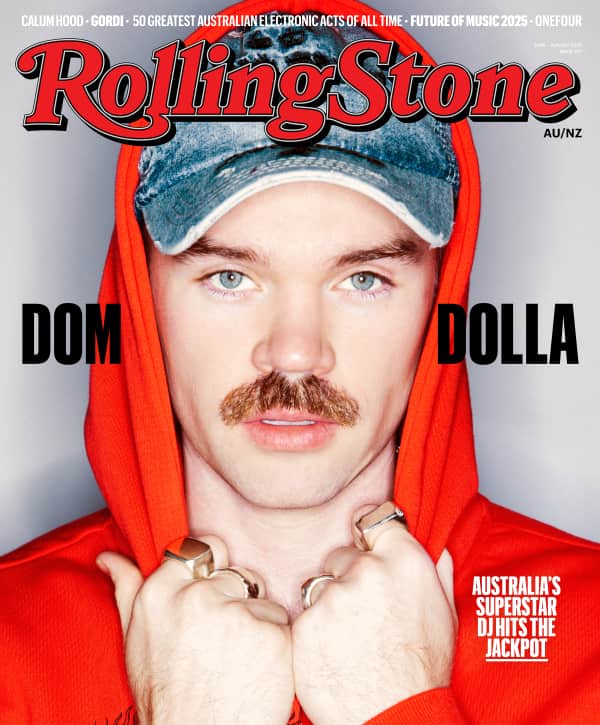

Love Music?

Get your daily dose of everything happening in Australian/New Zealand music and globally.

Analysts and politicians insisted the new bailout in the broad strokes was uncontroversial, a fire hose of money for virus-ravaged hospitals, workers, and small businesses. Even critics of Wall Street agreed that this one wasn’t a complete washout compared to the last disaster, when the taxpayer was asked to bail out the very people who’d caused the crisis.

“At least this bailout has a Main Street component,” says Dennis Kelleher of Better Markets, a financial watchdog group.

There are serious logistical questions about how money is supposed to get to Main Street – like for instance the use of the tiny Small Business Administration to push $377 billion in emergency loans out the door — but the larger problem has to do with the meat of the bill: backstopping of the financial sector.

As happened in the runup to September 2008, Wall Street in recent weeks warned of Armageddon if the Fed did not immediately start spending billions per minute to buy every conceivable kind of financial product.

The Fed responded by dusting off emergency lending facilities like the Term Asset-Backed Securities Loan Facility (TALF), the Commercial Paper Funding Facility (CPFF), the Money Market Mutual Fund Liquidity Facility (MMLF), the Primary Dealer Credit Facility (PDCF), the Secondary Market Corporate Credit Facility (SMCCF), the Primary Market Corporate Credit Facility (PMCCF), all of which saw action after the crash of 2008. Each would be used to step in and buy financial products in the various markets frozen due to virus panic.

The Fed furthermore announced that on March 23 it would begin buying $50 billion in government-backed mortgage securities, in addition to $75 billion in treasury bills, every day.

They’ve since lowered those numbers, but the scale of these interventions dwarfs any of the Fed’s actions post-2008. A $50 billion buying spree roughly represents as much Fed support of mortgage markets in one day as was done across a month at the peak of the last round of Quantitative Easing. Taken in conjunction with the CARES Act, the Fed and the Treasury were now positioned to become a major ongoing buyer of everything from mortgages to U.S. government debt to exchange traded funds (ETFs) to corporate bonds to money market funds.

The problem? A lot of these markets were already overinflated thanks to post-2008 bailouts and interventions like Quantitative Easing. We’re about to find out that the American economy has been living off dying, dysfunctional, or hyper-leveraged markets for over a decade. The Trump administration just bought this undead economy at retail prices and committed the Fed and the Treasury to sustaining it.

A major issue with the post-2008 bailout programs is that they tended to increase rather than decrease the risk in the system. A decade-plus of zero-to-low interest rates and massive central bank buying programs like QE made traditional safe havens unattractive and pushed investors to chase returns in a variety of not-so-healthy ways.

A few years ago, for instance, the infamous junk bond ghoul Mike Milken — the same one recently pardoned by Trump in a macabre symbolic show of solidarity for the bullshit debt economy — gushed to Bloomberg that America was in a “golden age” for private equity takeovers.

“This is their golden age. You can leverage, you can borrow without covenants, and so for equity holders it affords you a very unusual rate of return.”

Milken was pointing out that investors were so desperate to find higher rates of return that they were lining up to back the modern Gordon Gekkos — private equity titans like Bain, Blackstone, KKR, and Apollo — as they searched for companies to take over. At the time Milken gave this interview in Singapore in 2017, investors were sitting on some $963 billion in “dry powder,” money raised but not yet spent.

In their haste to get that money out the door (stop me if this sounds familiar) investors were relaxing demands for underwriting standards and other protections. This is what Milken meant by “buying without covenants.”

This dynamic spurred a boom in securitized commercial loans not totally unlike the boom in securitized mortgages pre-2008. An explosion of financing for private equity deals meant an economic landscape dotted with newly-conquered companies who now owed an array of fees and “special dividends” to their Wall Street masters.

Easy financing spurred investors to plunge money into junk or near-junk rated corporate bonds, allowing firms that were already swimming in debt to leverage up even more.

“Corporate debt since the bailout has grown to $10 trillion,” says Kelleher. “Of that, $3 trillion is a notch above junk level, what I’d call on the bubble of junk.”

It’s been estimated, for instance, that as many as 16% of American companies are “zombie companies,” i.e. they don’t have enough revenue to even pay interest on their debt. As Kelleher points out, many of these firms might not have survived even a mild economic downturn. Propping up this freak show, even if indirectly, is now going to become part of the War on the Virus.

Additionally, many financial markets that have been marketed as conservative and liquid actually depended all along on the presumption that these instruments could always be easily sold into a constant stream of easy money.

Money Market Funds, for instance, are supposed to be a safe, bank-like product. In 2008, however, panic after the collapse of Lehman Brothers forced the Treasury under George W. Bush to guarantee the entire $3.4 trillion market, to prevent a run of redemptions.

This triggered calls for reform, with many advocating the introduction of capital buffers to reduce or eliminate systemic risk. This was never done, and despite some changes Money Market Funds remained in reality an investment product, backed more by faith in market demand (and the promise of future bailouts) than by real value.

As a result, this supposedly safe market just had to be backstopped by the Fed again. “It’s just frustrating that we never really fixed this stuff to begin with,” said former FDIC chief Sheila Bair.

The notion that the Fed can endlessly pump new money into the economy once inspired fears of inflation, but the Covid-era mantra is that “Unlimited QE” or “QE infinity” no longer carries such dangers.

“Markets will have learned well from the 2008 experience that this increase in balance sheet size is not inflationary in any near-term sense,” Citigroup economist Andrew Hollenhorst said last week.

Translation: keep the money coming. This is what Wall Street was saying even before the passage of the CARES bill. The new mandate is that the bank will keep buying all of this stuff, endlessly, until — well, we’ll find out when we get there.

The Fed “balance sheet” as of Friday was already at $5.3 trillion, nearly $800 billion higher than its previous peak in May 2016. Wall Street analysts are predicting this number will eventually reach $10 trillion, and why not? Fed chief Jerome Powell signaled that assistance would be unlimited, when he said the central bank “would not run out of ammunition.”

As with 2008, the emergency support is supposed to be temporary, but there’s less belief that this is even ostensibly true this time around. There will be a lot of howling over the irony: Trump when he ran for president in 2016 said then-Fed chief Janet Yellen should be “ashamed” of creating a “false stock market” for Barack Obama. Our future will be a parody of the Yellen economy.

Short-term loans to make payroll and keep tenants in storefronts are only a part of the rescue. The coronavirus emergency is probably temporary. The bailout looks like forever.