A California appellate court handed a victory to Michael Jackson’s estate executors Wednesday, issuing a final written opinion confirming the singer’s mom Katherine Jackson had no basis to challenge a lower court’s blessing of a $600 million catalogue deal with Sony.

The new opinion, which essentially adopted a tentative ruling first reported by Rolling Stone last month, described the secret 2022 Sony deal as a “joint venture” that estate executors John Branca and John McClain had the right to broker while Jackson’s estate remains in probate, a court-supervised process for handling will disputes. (Details of the confidential catalog deal were first reported by Billboard and later confirmed by Rolling Stone.)

In the new 19-page opinion, the three-judge panel described the confidential deal as a transaction that involved “transferring a significant portion of the estate’s assets to a joint venture between the estate and a third party, in exchange for a large cash payment and an interest in the joint venture.” Katherine opposed the deal on the grounds that it violated the terms of her son’s will, specifically a provision that says all of the estate’s assets must be distributed to the trust naming his children and mother as beneficiaries once probate closes.

In her appellate filings, Katherine argued that allowing the estate’s “single most valuable asset” to be transferred to a “new company” owned “only party by the estate” was fundamentally inconsistent with Michael’s wishes. She said the deal made it “impossible” for executors to transfer the “entire estate” to the trust. The appellate judges rejected that position. They said Jackson’s will “give the executors broad powers to manage estate property while the estate remains in probate,” so the prior judge did not abuse his discretion when he granted the petition for approval of the deal.

“Were the effect of the court’s order to ‘give’ an estate asset to a third party, we might agree that the order violates the will,” the three judges in California’s Second District Court of Appeal said. “But the proposed transaction is not a gift or distribution of estate assets — it is an asset sale, pursuant to which the estate receives a significant monetary payment and interest in a joint venture in exchange for the transfer of assets.” The judges said the deal “neither diminishes the estate’s value nor impairs the executors’ future ability to transfer the estate’s assets to the trust.”

“The probate court did not err in concluding that it was Michael’s intent to allow the executors to sell any estate assets, including those at issue in the proposed transaction,” the judges wrote in their conclusion.

Jackson’s estate has remained in probate since his 2009 death largely due to ongoing tax disputes with the IRS. Once probate closes, the entire estate will be transferred to the trust naming Jackson’s three children as the principal beneficiaries and Katherine as a lifetime beneficiary of a sub-trust that will revert to the main trust upon her death.

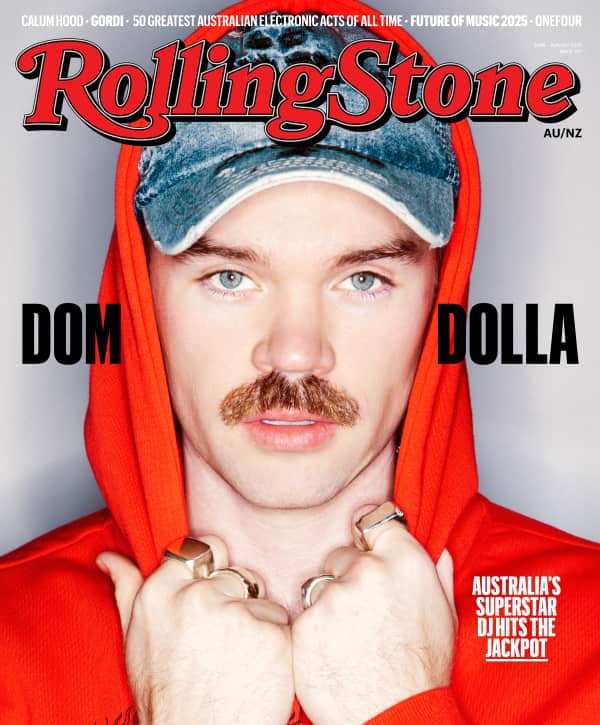

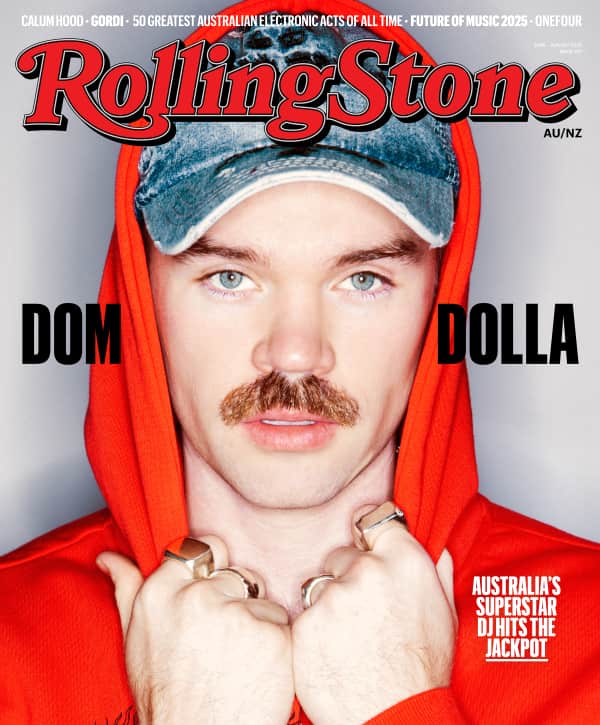

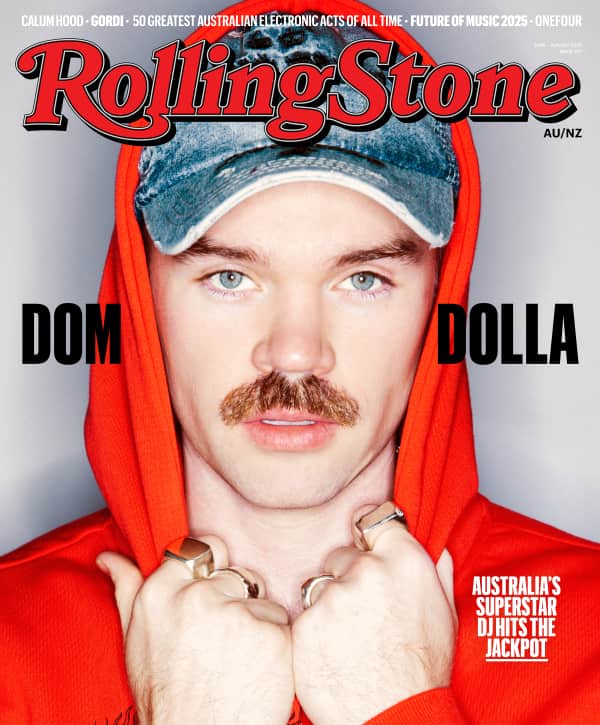

Love Music?

Get your daily dose of everything happening in Australian/New Zealand music and globally.

Katherine’s lead lawyer on the appeal and a lawyer for the estate did not immediately respond to Rolling Stone‘s request for comment.

According to an appellate brief previously filed by the executors, the asset sale was negotiated to take advantage of a market that was “by far” the “hottest it had ever been.” The deal, which closed amid Katherine’s appeal, lets the estate maintain “effective control over Michael’s music” while diversifying its range of assets, the filing reads.

In a heavily redacted filing obtained by Rolling Stone, estate lawyer Jonathan P. Steinsapir called the deal a “remarkable” one that gives the estate “the best of both worlds” in terms of tax benefits and earnings. He said that under the deal, the estate retains the right to control “critical decisions” related to Michael’s name, image, and likeness and exercise day-to-day control over his trademarks. “Over the past 14 years, the executors have exercised their powers with extraordinary care and extraordinary diligence with extraordinary results. As the probate court recognized in its [underlying decision], ‘What started out as nothing but debt and substantial ongoing obligations has been turned into a $2 billion estate,’” he wrote.

None of Michael’s three adult kids — Prince, Paris, and Bigi Jackson — filed written objections to the estate petition for court approval of the transaction. Lawyers for Prince and Paris said at a March 2023 hearing that they did not object. A lawyer for Bigi reserved the youngest sibling’s right to object, court filings state. During the evidentiary hearing, Paris appeared briefly to say she joined her grandmother but did not say specifically what her objection was, the new opinion released Wednesday states. “The court noted subsequently that it was ‘not really even sure what Paris Jackson’s position is,’” the new opinion says.

In March of this year, Bigi’s lawyer David Coleman wrote to the court this his client considered the asset sale of “paramount significance,” both financially and personally, but that he did not support Katherine’s appeal. Coleman said his client initially “believed that the executors should prove the necessity of the proposed transaction to the court,” but once the transaction was approved, he accepted that the deal couldn’t be stopped. “The chances of a reversal on appeal were quite slim, and Bigi did not wish to incur further expense in pursuing an appeal,” the lawyer wrote.

Jackson was 50 years old when he died of an accidental overdose of the surgery strength anesthetic propofol at his rented mansion in Los Angeles on June 25, 2009. A major roadblock to the funding of his heirs’ trust is the tax dispute involving more than $700 million in alleged unpaid taxes and penalties. According to estate filings, the final liability paid by the estate will be a “tiny fraction” of that amount thanks to legal maneuvering. The valuation of one remaining, unidentified asset is holding up final resolution of the tax issue, the estate has said, and in the meantime, the IRS continues to have a lien on estate assets.

Beyond the tax issues, Jackson’s companies are again defendants in revived lawsuits from two of his molestation accusers, Wade Robson and James Safechuck. The men claim the companies are liable for their alleged abuse as children. A trial readiness conference in the case is set for Thursday in Beverly Hills.

From Rolling Stone US