Live Nation will have to prove it does not hold a monopoly over live events if it hopes to avoid a breakup with Ticketmaster, legal experts say. But in looking ahead at a possible years-long fight with the Department of Justice following their bombshell, 124-page lawsuit, the world’s largest concert promoter points to past antitrust cases as reasons they’re not worried about the suit’s outcome.

Following a two-year investigation, the DOJ claims that Live Nation, the parent company of Ticketmaster, holds an illegal monopoly given the company’s 80 percent market share for primary ticket sales in the nation’s largest venues. The suit describes how fees are collected from every aspect of a live event — from merchandise to concessions to parking — and alleges venues have no choice but to partner with Ticketmaster to sell tickets to shows.

The company has stated it has more competition than ever, and that neither Live Nation nor Ticketmaster have unilateral control over ticket pricing – it’s the artist who sets the ticket price. The company contends there’s high demand for tickets at those prices given how much consumers are willing to spend on secondary ticket sales.

During an investor call Thursday following the lawsuit, Live Nation executives stressed fees are set by venues, which keep the bulk of any profit. “They have gone from taking a substantial portion to even more of the service fee,” One exec said. Instead, the fees are a negligible line item for the company, executives claim, arguing that “even if you take our entire take rate” – the end profit a business makes from transactions after taxes and items like service fees are removed – “that would have a single digit impact on the price of the ticket.”

However, a source familiar with the DOJ’s investigation argues that statement underscores why the suit came forward with a bipartisan group of 30 state and district attorneys general.

“They might want to trivialize the amount of money that people are paying for concerts. But that money means a lot to people. That cost is real to so many Americans,” the source tells Rolling Stone. “And I think they would be well served not to diminish the seriousness with which the public takes this issue.”

A rep for Live Nation declined to make executives available for an interview. But top brass from the company said on the call that they didn’t believe the Justice Department could ask for a breakup given the lack of accountability within the ticketing industry. “By those circumstances, we just don’t really believe there’s any good faith argument to be made here,” said Dan Wall, Live Nation’s Executive Vice President for Corporate and Regulatory Affairs.

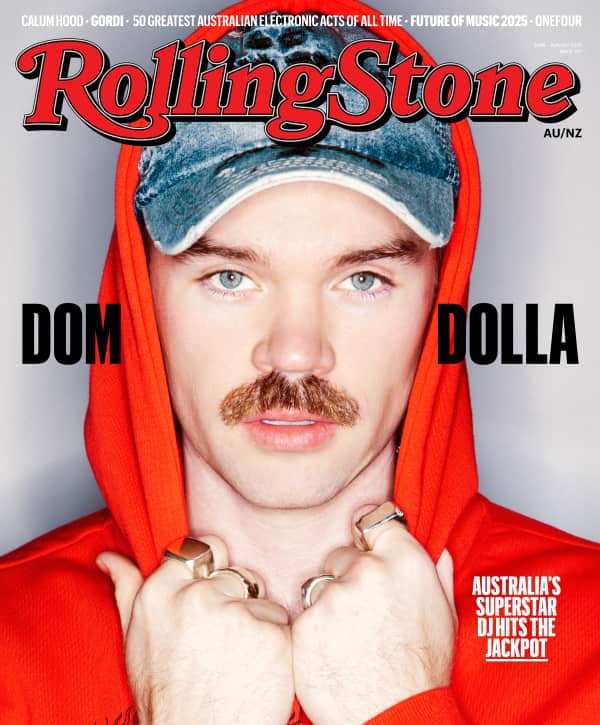

Love Music?

Get your daily dose of everything happening in Australian/New Zealand music and globally.

But antitrust legal experts take issue with the claim. “That’s not a serious critique. To say that it’s not a good faith argument is ridiculous,” former Acting Assistant Attorney General of the DOJ’s Antitrust Division Richard Powers tells Rolling Stone. “This has been an ongoing issue since [Live Nation and Ticketmaster merged] in 2010.”

At the time, the DOJ applied restrictions so the company would pledge not to tie its services together or retaliate against venues that didn’t use Ticketmaster. Conditions of the settlement were set to expire after a decade. But in 2019, the DOJ revised its deal to add an anti-retaliation clause after finding evidence Live Nation threatened to withhold shows from venues that didn’t sell tickets through Ticketmaster. The revised deal also appointed an outside law firm to oversee compliance from Live Nation, which was subject to a $1 million fine for each violation of the new deal terms. Live Nation released a statement at the time saying that they had reached an agreement with the DOJ. “We believe this is the best outcome for our business, clients and shareholders as we turn our focus to 2020 initiatives,” the statement read.

In the years that followed, Live Nation is alleged to have “colluded” with other competitors to avoid splitting the market, according to the DOJ; forced its investors to pressure competitors from entering markets; and held long-term exclusive deals with venues that prevent any viable competition from those markets.

“The DOJ’s complaint attempts to portray Live Nation and Ticketmaster as the cause of fan frustration with the live entertainment industry,” Wall said. “It blames concert promoters and ticketing companies — neither of which control ticket prices — for high ticket prices. It ignores everything that is actually responsible for higher ticket prices, from increasing production costs to artist popularity, to 24/7 online ticket scalping that reveals the public’s willingness to pay far more than primary tickets cost.”

Other legal experts say it’s not as simple. “The complaint puts a lie to a lot of that. It shows how in their internal communications, they worked to block competition, pressure artists to go through them, [and] control so many different key venues,” said Bill Baer, the only person to have led antitrust enforcement at both U.S. antitrust agencies, serving as Assistant Attorney General for the DOJ’s Antitrust Division and as Director of the Bureau of Competition at the Federal Trade Commission.

During the investor call, Live Nation executives referenced the Google and Microsoft antitrust cases, arguably the two biggest antitrust cases of the past 25 years. The company stated that Microsoft was able to win its appeal and avoid a breakup because monopolization practices were not “rooted in corporate structure.”

In 1998, the DOJ, along with 20 states, filed a case against Microsoft alleging the company had illegally monopolized the web browser market for Windows computers by placing restrictions on both PC manufacturers and consumers to uninstall Internet Explorer and use other web browsers such as Netscape and Java. Two years later, a judge ruled Microsoft had a monopoly on web browsers because the company bundled Internet Explorer with their operating system, and ordered the company to break up into two different companies: one for their operating system, and one for any other software.

Microsoft appealed the decision, insisting Internet Explorer was a feature and not a product, and cited the judge’s violation of the Code of Conduct for giving an interview before the case was determined. Microsoft won the appeal, and instead of breaking up, the company was required to allow other web browsers to operate on their systems.

Fortnite maker Epic Games sued Google in 2020 for using its size and strength to block other app stores from selling on Android phones. The suit stated Google intentionally made it too cumbersome and worrisome for Android users to download apps from a marketplace that was not the Google Play Store. Epic argued users should be able to download content directly from developers, just how they can do so on a desktop. In December 2023, Google agreed to settle the case and was ordered to pay $700 million to American consumers.

Karma Giulianelli worked on both the Microsoft and Google Play Store antitrust cases, serving as a lawyer for Microsoft’s trial team and as Google’s lead consumer lawyer. She said the biggest hurdle for the DOJ would be to actually define what a “market” is, the main point of contention in an antitrust case.

“Both Live Nation and Google serve as distribution outlets and both charge fees for distributing the products they distribute. The charging of a fee in and of itself does not violate an antitrust law. So you cannot be held liable for charging too high of a fee,” Giulianelli tells Rolling Stone. “The problem results when there’s no competition to the distribution outlet or the store. It’s the alleged conduct that excludes competition that could violate the law. Not the fact that they’re charging a high fee.”

Live Nation says the 80 percent market share figure only accounts for a small fraction of venues it operates in across the country and is not representative of the market as a whole, meaning Live Nation faces more competition and less profits everywhere else.

Baer takes fault with that defense. “We don’t make all that much money? You don’t get to go market by market. If you’re a monopolist who has misbehaved in Market A, you don’t get to subtract the fact or defend on the grounds that in Market B, you’re not making monopolies. That’s not how antitrust works.”

The DOJ is opting to try the case before a jury, which Live Nation executives called “a stunt and a strategy the DOJ used in the Google ad case, and it’s unusual for antitrust cases.” Powers pointed to the “pretty strong support from a bipartisan group of state attorneys general” as to why Live Nation might not appreciate the jury trial. “It’s diverse from New York to Texas, the attorneys general have signed on to this,” Powers said. “It’s like trying to deflect responsibility. It’s almost like personalizing it.”

Criticizing the case for being tried before a jury “goes contrary to our antitrust and antitrust jurisprudence,” Baer said, explaining that neither the FTC nor the DOJ have the authority to obtain monetary damages unless there is another government entity that is injured – which is not part of this complaint. “But the fact that you’ve got over half the union’s states, they do have that explicit authority to seek monetary damages on behalf of their injured consumers. They’re absolutely entitled to ask for a jury trial.”

Despite the statements and portrayals of facing financial hardship with increased competition, Live Nation is doing well. Its profits exceeded $23 billion last year, up 36 percent from the year before. Even news of the lawsuit seemed to stabilize for investors later in the week. When reports of the possible lawsuit first came out in April, its stock plunged nearly eight percent. On Thursday, it dipped 6.6 percent before showing signs of improvement ahead of the weekend.

From Rolling Stone US