Kings of Leon/Supplied by Sony

One of the most talked about digital products in the world at the moment are NFTs—so much so, they may even challenge cryptocurrencies for attention-grabbing headlines.

There are plenty of question marks around NFTs at the moment—but the biggest question is whether NFTs are a bubble about to burst, or the beginning of a boom.

A lot of the chatter online about NFTs places them mostly in the “uncharted territory” realm. But regardless of the looming question marks, a huge number of musicians, sportspeople, and artists have been cashing in on NFTs steadily over the past year, albeit to mixed success.

NFTs Defined

An NFT is a unique identifying code attached to a digital work such as a piece of art, music, or a video. Think of it like a one-off digital “signature” which cannot be hacked.

That’s because it uses the same blockchain technology as cryptocurrencies like Bitcoin or Ethererum—a database consisting of a system of individual computers working in tandem to decentralise identifying information, ensuring its transaction data is both irreversible and transparent. This allows the work to be authenticated easily, and traded on the open market.

In simple terms: NFTs allow artists—or anyone, for that matter—to create unique digital products or artworks, of which only one version exists. So if you were to buy an NFT, you would be the only person in the world to own it.

To create an NFT, a creator must upload their work to a digital gallery or NFT market, then pay in Ethereum to have it “minted”—that is, generate the code to add it to the Ethereum blockchain.

Who is Behind the NFT Boom?

Most of the NFTs pulling in huge sums of money have been released by the art world. In a way, it makes sense that this is the first industry to take advantage of this technology—after all, artists have been creating their work digitally for years.

Love Music?

Get your daily dose of everything happening in Australian/New Zealand music and globally.

NFT art is hot right now—so hot that even celebrities like Paris Hilton are jumping on the bandwagon to mint their own NFTs. A digital likeness of Hilton, named ‘Iconic Crypto Queen’, sold for the eye-watering sum of USD$1.1 million (AUD $1.47 million). It doesn’t even hit the top ten list of the most expensive NFTs ever sold.

That top spot goes to famed digital artist Mike Winkelmann, known professionally as Beeple, whose piece Everydays: The First 5000 Days sold earlier this year at Christie’s for a staggering USD$69 million (AUD $92.3 million).

The sporting arena has followed closely behind, with a throng of international sporting brands and sportspeople flocking into the NFT space to claim their cut. NFL tight end Rob Gronkowski recently released more than 300 NFTs featuring his best Superbowl moments, while the NBA made a digital move into the collectibles market with NBA Top Shot—an NFT-based version of the classic baseball card.

Sean Callanan, co-founder at esports and gaming marketing company Play Media, believes the opportunity for NFTs lies in the scope for fan engagement.

“There’s a lot of buzz around NFTs at the minute,” he explains. “Everyone is leading into that collectible space, and the advantage is that it mitigates the risk around counterfeits, which is a problem in a lot of real-life collectibles like trading cards and the like.

“I guess the longer term play is, what’s the utility, and how can it be tied into enriching the fan experience?” continues Callanan. “I think there’s a case for NFTs becoming the new backstage pass, and giving limited access to limited fans—so that it becomes a real high-value item.”

The fashion industry has been tentative, on the other hand. Although Gucci released a USD$12 (AUD $16) virtual sneaker (that you could never wear…) last year, they are yet to upgrade to an NFT release. Instead, NFTs have mostly taken the form of virtual fashion pieces—either superfan digital collectibles that are sometimes accompanied by a real-life version as a bundle, or unique clothing items for your gaming avatar.

One such item, a virtual hoodie from streetwear label Overpriced, sold for £19,000 (AUD $35,000) in April this year, while virtual shoe brand RTFKT Studios swept USD$3.1 million (AUD $4.15 million) into their coffers with a virtual shoe release.

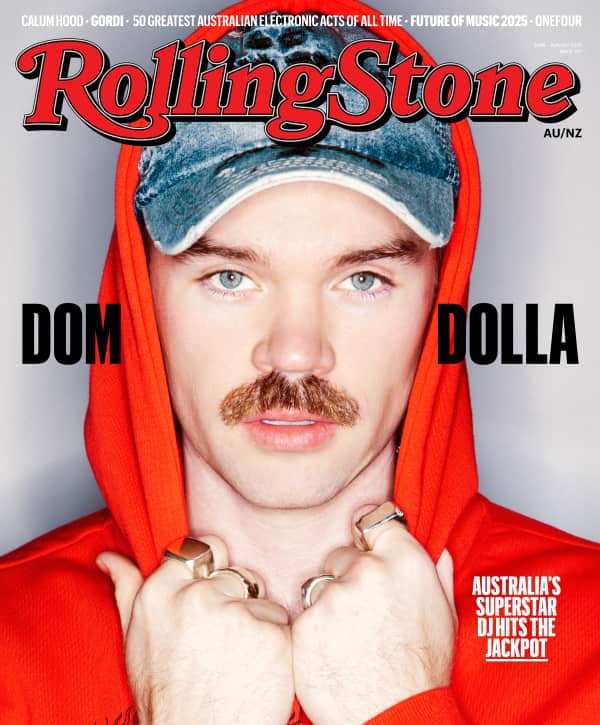

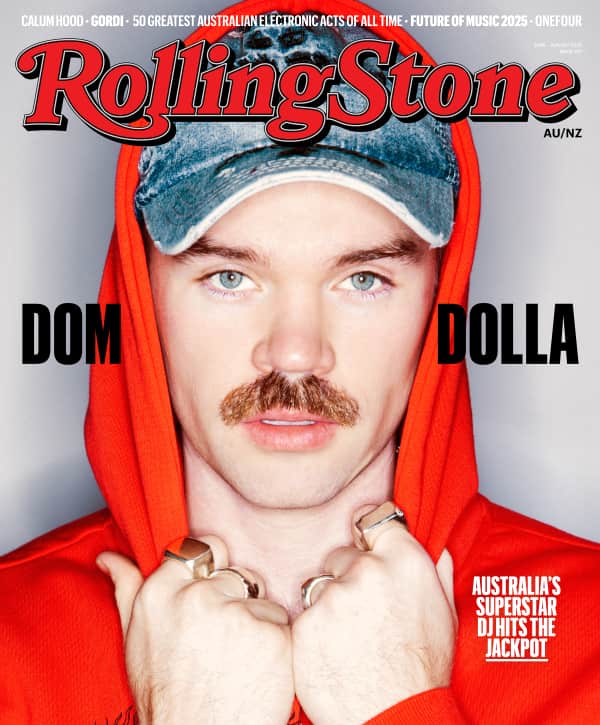

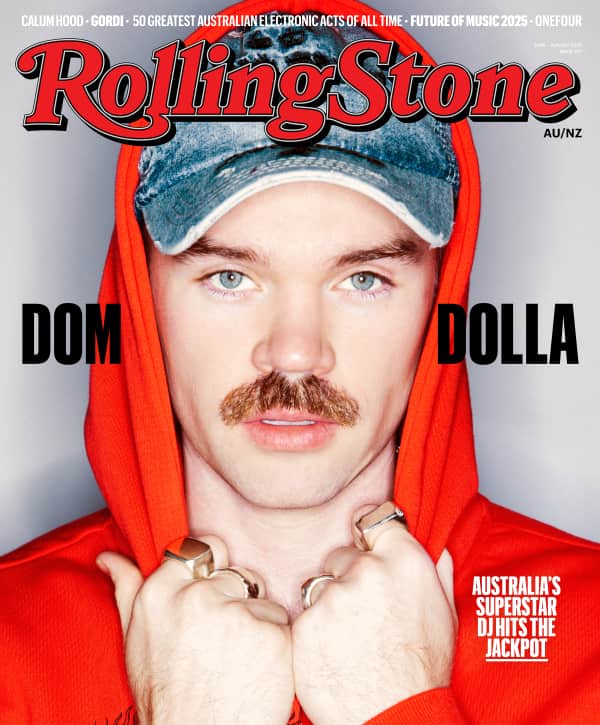

Or, why not buy yourself some NFT “real estate”? You could then monetise it by erecting a virtual billboard via an augmented reality app called SuperWorld. Even glossy magazines have entered the digital fray. Rolling Stone Australia itself jumped on board the crypto train in July, making history with the first ever Rolling Stone NFT by releasing its Tones And I cover as a limited-edition NFT.

And then we come to music; one of the most interesting spaces for NFT ideation right now.

A Global Pandemic, the Death of Live Music, and The Rise of NFTs

When someone like music industry expert Cherie Hu, founder and publisher at Water & Music, says “NFTs could save the music industry”, it becomes hard to ignore them as a fad. But there are so many varying opinions on the financial stability of the music industry that it becomes hard to nail down a single outlook on the strength of the market for new revenue opportunities, like NFTs.

Even streaming—which has dominated the market for quite a few years now—is still a subject of debate, depending on perspective. For every industry commentator or record company executive lamenting the reduction of income due to the rise in streaming, there is an independent artist or tour manager who will argue that music’s overall revenue is at its highest since the early Aughts.

That being said, there’s no doubt the market has changed dramatically in recent years, particularly when it comes to income from touring, which on average accounts for about 75% of an artist’s income. But what happens during a global pandemic, when you can’t tour? According to some of the biggest names in music, you make NFTs.

What happens during a global pandemic, when you can’t tour? According to some of the biggest names in music, you make NFTs.

However, while the art community has monetised the idea of a single, unique object as a valuable collectible with investment potential, music has spent many years delivering as many affordable copies of their art as possible, to sell on the open market. So how do you create that same appetite for a premium one-off object in a music consumer, who is used to owning one edition of millions?

The solution for many musicians has been to partner with digital artists, creating exclusive soundscapes to accompany visual NFT artworks. Most recently, DJ and producer Dillon Francis paired up with artist Chad Knight for a release on Nifty Gateway. Meanwhile, singer-songwriter Tove Lo soundtracked an acid-tinged virtual bust in 3D called Crypto Tits.

Dance music icon Calvin Harris believes NFTs can “revolutionise the music industry”, after selling just one of the five pieces from his ‘Technofish’ series, created with music video director Emil Nava, for USD$108,000 (AUD $145,000). Even local producer Flume got in on the action, selling a 90-second artwork of a rainbow-coloured eye by Jonathan Zawada, soundtracked by his music, for USD$50,789 (AUD $68,000).

Perhaps the most successful NFT release within the music realm so far was from synth-pop pioneer Grimes, who sold a single NFT—named War Nymph for her mysterious alter ego—for USD$389,000 (AUD $521,000). This was sold along with two other pieces in an edition of 700 copies for USD$7,500 each (AUD $10,000). In total she raked in nearly USD$5.2million (AUD $6.96 million).

Sure, the dollar amounts sound impressive on paper—but is digital art accompanied by soundscapes really delivering on the potential of NFTs? Perhaps the project that gives us the best hint is the release of Kings of Leon’s latest album as an NFT.

The project that gives us the best hint of NFTs’ potential in music is the release of Kings of Leon’s latest album as an NFT.

At first glance, it seems like a simple case of a mega rock band jumping on a digital trend. After all, why would you buy an album as an NFT, when you could just buy it as… an album? But the devil is in the details. Not only did Kings of Leon sell three versions of the album with exclusive offers contained within, but one of them even included a particular touring perk—buy that NFT album version, and you’ll have front-row seats guaranteed. For life.

Now, here’s something music fans can truly appreciate: far from a highbrow digital art piece they might not really “get”, let alone display easily, is an offer of a real, life-long touring perk that has an intrinsic, easily understandable value attached—and genuine on-sell potential.

How Could NFTs Change the Music Industry?

The music industry is currently a heavily royalty-based system. Record sales, licensing deals, music use, streaming—they’re all closely monitored and tallied in order to deliver an income stream to the rights holders. While streaming ensures ongoing royalties, for example, by paying a tiny amount per stream, a physical record purchase has traditionally delivered a single payment to the royalty holder, no matter how many times you listen to the album. And if the fan who owns the record sells it—even potentially for more than they initially paid, depending on rarity—the royalty holder doesn’t get paid again. This is where NFTs come in.

Arguably, one of the most lucrative benefits of NFTs lies in the immutability of the blockchain code. Within that code you can include what is known as a “smart contract”. Smart contracts ensure that the artist earns ongoing royalties with each re-sale—which, as visual artists know, is a huge new area of income potential.

Arguably, one of the most lucrative benefits of NFTs lies in the immutability of the blockchain code.

Noted creators such as US sculptor Jeff Koons or Chinese contemporary artist Ai Weiwei, for instance, may sell their pieces for huge amounts of money initially. But often many years later, when the pieces have doubled or tripled in price, they miss out on cashing in from that sale. With NFTs, the artist will receive a percentage—often around 10%—for any future sales as well. And you don’t even need to engage a third party to track those sales—a manager, for example, or in the case of music, a record company—because the blockchain does it for you.

Within the music realm, this presents some enticing opportunities for artists who have been lured into the record company system, based on the advantages of having the weight of their admin, royalties, PR, and marketing taken care of by someone else.

It’s not hard to see how something like the offer of front row seats for life, coded into a superfan NFT release, may increase in value over time as the artist grows in popularity. This adds an ongoing income stream for those willing to give the minting process a crack.

Some artists are even selling “shares” in their royalties—often for songs that haven’t even been released yet. In February, Canadian electronic producer Jacques Greene offered a share in the royalties of an unreleased track “Promise” as an NFT, in exchange for Ethereum.

“This NFT represents the AV clip,” he said about the release, “but also the publishing rights to the eventual song release […]. I got out of a long, pretty bad publishing deal with a big company last year—a big personal and professional victory!”

He sold the rights to a single buyer for just under USD$23,000 (AUD $31,000) at the time. Although the new owner will hold the copyright to publishing the song, Greene holds the right to approval.

Deals like this are just one of the reasons commentators believe NFTs could transform the way the music industry does business, forging a new path for independent artists in the wake of exciting technology developments. After all, if the music industry has learned one thing in recent years, it’s surely that when tech companies are involved, disruption will soon follow. In the end, it’s up to the record companies to innovate.

Harry Hayes, Digital Manager at [PIAS], agrees. “It’s definitely going to challenge [them],” he says. “In the short term, it’s going to be a lot of learning […] I feel like good record labels are always going ‘What’s next, and how can we be a part of that? How can we provide infrastructure for artists to take advantage of that opportunity? The risk is that, whilst labels might be trying to catch up, there could be a lot of new players that come in and say, ‘We know exactly what’s going on’.”

Hayes sees the potential for NFTs similarly to Callanan—as a luxury for superfans, and a way for them to show their support through unique collectibles and a sense of “ownership”. “The ultimate place I can see it getting to is that an artist is ‘owned’ by their fanbase,” he says. “That’s something that I’m shocked hasn’t happened a lot—I think fan clubs, and e-newsletters, and social media to a degree does that, but now that it’s embedded in Ethereum and the blockchain. It’s a financial investment.

“For example, I would have loved to have bought a Billie Eilish token when she was one year into her career—I would have been like, I want to get in on this, I want to show I was there from the start. I think that’s really appealing [for fans].”

Hayes is right. NFTs, beyond the monetary implications, deliver the capacity for fans to express their support for their favourite creators. So much so, it’s not hard to imagine artists being signed to deals based on successful NFT sales early in their career, in the same way YouTube subscribers were a luxury for young artist deals in the 2010s.

But is it truly possible that NFTs could cut out the need for a record company altogether? For the artists who are happy to go it alone, it’s no question. Will this throw out the balance of power within the industry, skewing it towards the artist, rather than big corporations?

Well, that depends on who you’re asking.

“I find this model has the potential to value fans that have a lot of money,” Zola Jesus told Pitchfork recently, of her own experiences with releasing NFTs. “The emphasis on wealth and finance in this space is pretty fundamental to what it is, which puts the art at risk of being inevitably controlled by capital—just like we have with corporate dominance in the music industry.”

Emerging Sydney R&B pop artist Gia Vorne has a more optimistic outlook of the fledgling industry. “It depends on which type of rich and powerful people have control. If you are in the right hands—people who really understand music, and are willing to make a better change for the industry—then I think NFTs are going to give the power to artists.”

“You’re creating a whole new element for people to experience… it’s adding this whole new direct line between [fans] and the artist. And also putting value back into the people who create the art, instead of the machine that puts it out.”

In the end, the exchange of money is really just an exchange of power, and with all these million dollar paydays flying around online, it’s hard not to agree with Vorne. For now, she rightly proclaims that the lure of NFTs for young artists lies squarely in the appeal of creative control—however illusory that may be.

“We’ve had the traditional way of releasing music, where you have an idea of the process, but it’s kind of trying to forget all of that and pave your own way and try something completely different—which can be a little bit daunting, especially for a small artist.”

“Everyone would love to stay as an independent artist. I would assume that people want to have as much power and control over their own art as possible.”

Meanwhile, for new artists keen to jump into the NFT space, though they may not have to answer to a panel of record company executives before cashing in on their creative output, they should also be wary of tech giants looking to disrupt their industry.

The veiled moral of this story, in essence, is: it’s time to choose your master.