In March, Steven Wilkin was among the millions of American who lost their primary source of income. Wilkin makes music under the name Adult Bodies; he supplements that money by working for Uber and Lyft, as well as doing other odd gigs. When wide swathes of the economy started to shut down, he quickly filed an Unemployment Insurance (UI) claim. “I thought I’m going to get the full benefit available in California, which is $450 a week,” Wilkin says. “Three or four days after I filled out that information, I received a letter that said my awarded benefit was $77 a week.”

“I remember being filled with an all-consuming fear,” Wilkin continues. “My body literally started shaking. What am I gonna do with $77 a week? I can’t even buy groceries with that. How am I gonna pay my rent?”

Many musicians whose income comes from hybrid sources — some from independent contractor jobs, which are accounted for on the tax form known as the 1099, and some from standard W-2 employment — have found themselves in the same position as Wilkin. If their W-2 income exceeded $1,300 in California during any quarter in the past 18 months, they are eligible for state UI, which means they cannot participate in the Pandemic Unemployment Assistance (PUA) program designed explicitly to cover independent contractors and gig workers. But their UI benefit will be awarded only based on that W-2 income — which in Wilkin’s case is roughly 3% of his total. It’s as if all his 1099 income does not exist.

“It’s a mess,” says Jack Kugell, a veteran writer-producer (Martina McBride, Angie Stone). “It’s a mess for everybody, but it’s especially a mess if you have an imbalance between your W-2 and your 1099 income.”

Keith Levenson, musical director and conductor for the Who, prefers a different description: “It’s a clusterfuck of enormous proportions,” he says. A Change.org petition titled “Fix the UI vs PUA Problem” has already amassed more than 3,500 signatures.

The “clusterfuck” is a presumably unintended consequence of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Signed into law by President Trump on March 27, the act was intended to provide emergency assistance to the millions of Americans who lost their jobs as the global pandemic shut down the economy.

The CARES Act includes roughly $260 billion to help the recently unemployed, according to the National Employment Law Project. This is partly through two programs, Pandemic Unemployment Compensation (PUC) and Pandemic Unemployment Assistance (PUA). The PUC provides an additional $600 a week to everyone collecting benefits through the end of July.

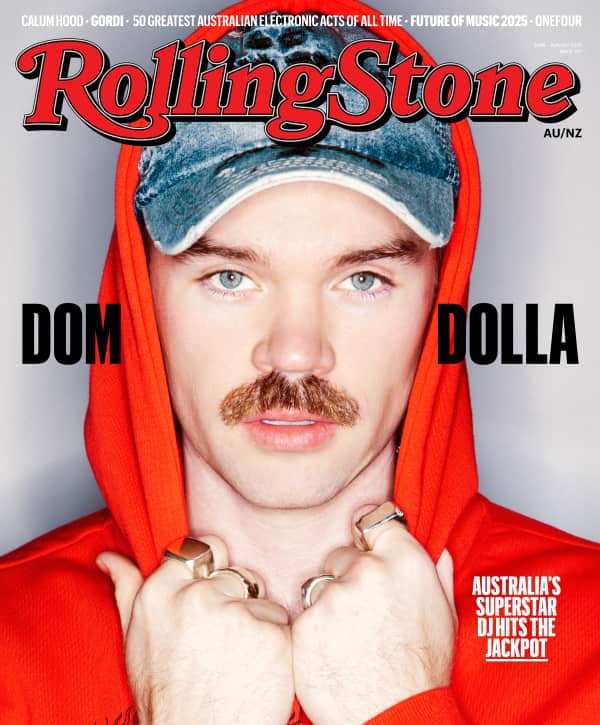

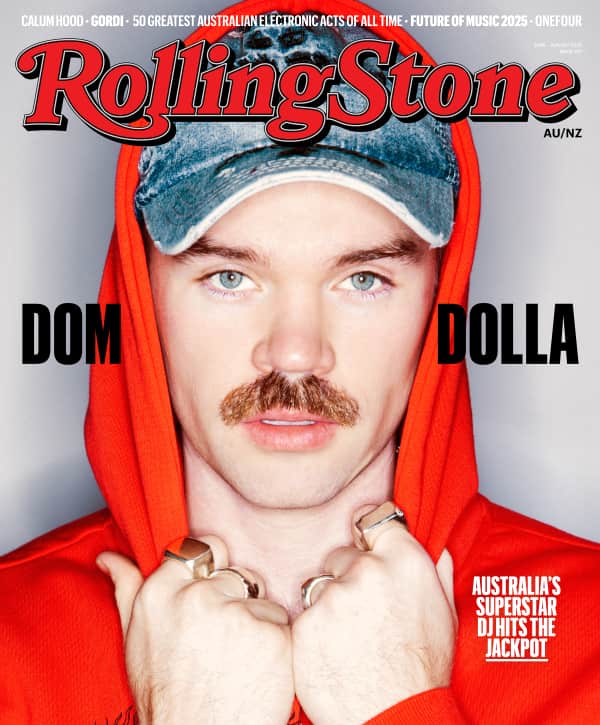

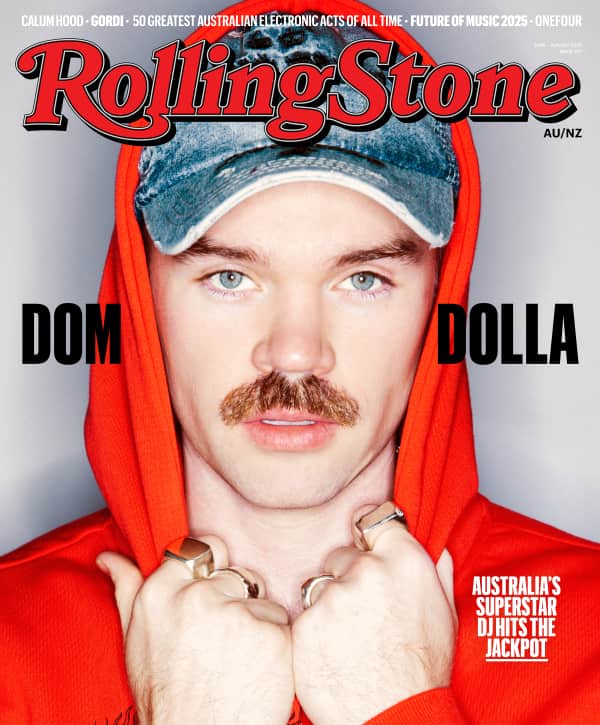

Love Music?

Get your daily dose of everything happening in Australian/New Zealand music and globally.

The PUA, alternately, is directed specifically at independent contractors, who are not typically eligible for unemployment insurance. That’s because unemployment insurance is funded partly by payroll taxes paid by employers to the government. Crucially, payroll taxes are only deducted from income reported on W-2 forms. Since independent contractors are usually not paid in this fashion, they generally don’t pay into the insurance fund, and so don’t benefit from it. The CARES Act expands the safety net to try to protect these workers as well. “The PUA is the first time in history that Congress has provided unemployment insurance for independent contractors,” says Catherine Fisk, a professor at UC Berkeley School of Law who specializes in labor and employment law.

“The difference between $50 and $450 [a week] is huge. This is money people really need.”

But the labor force doesn’t cleave cleanly into two non-overlapping pools of workers anymore. “The unemployment system was originally designed on the assumption that either you’re a worker or a business owner and you have investments and assets,” Fisk explains. However, the number of category-blurring workers like Wilkin has grown rapidly in recent years.

Fisk suspects those workers were overlooked as Congress rushed to put together legislation to combat economic contraction. “I think it’s a drafting error, and it should be fixed,” she says.

Jordan Bromley, a partner at Manatt Entertainment, estimates that there are at least 100,000 hybrid-income workers in California alone. He expects their complaints to swell since the portal to apply for PUA in the state was only established at the end of April.

Kugell’s situation is similar to Wilkin’s: He amassed $1,800 in W-2 income in 2019 through a pair of session gigs, but he picked up more than $100,000 in 1099 income. If all his income came through W-2 work, “I believe I would have been eligible for the $450 [UI benefit],” he says. “And if I had no W-2 income, I’d qualify for the PUA, which pays out a minimum of $167 a week in California.” Instead, Kugell is eligible for $50 a week through state UI based on his small amount of W-2 income.

Until the end of July, he will also receive the $600 a week from the PUC. “The best thing we can do at the moment is be grateful for that,” Kugell says. Still, “the difference between $50 and $450 [a week] is huge. This is money people really need.”

Bromley and Kugell have both been pressing government officials about a potential fix for hybrid-income workers. Bromley is a member of the Music Artists Coalition, an advocacy group that lobbies state and federal organizations on behalf of musicians. “About a month ago we started sending letters to state governors and labor secretaries [to draw their attention to this issue],” Bromley says. “We’ve gotten on the phone with some state labor secretaries and unemployment officers. They’ve basically told us their hands are tied due to the way the CARES Act is written.”

“It’s great that the CARES Act happened to finally recognize 1099 workers. But nobody’s equipped to deal with it.”

At the same time, Kugel says, “the Department of Labor said it’s something the states have to deal with.” “But,” he adds, frustration creeping into his voice, “this only became an issue when you guys passed the CARES Act and made 1099 income a viable way to get assistance!”

For now, workers with both W-2 and 1099 income must continue to rely primarily on the PUC benefit and hope that someone in government devises a remedy before the end of July. Some musicians are deciding not to report their W-2 income, hoping that will allow them to get PUA benefits based solely on their 1099 work.

But even if they qualify for the PUA, benefits are arriving “at a snail’s pace, and filled with inconsistencies,” according to Levenson, who is based in New York. “It’s great that the CARES Act happened to finally recognize 1099 workers,” he adds. “But nobody’s equipped to deal with it. The week of July 23, this $600 runs out. People are starving, and it’s gonna get worse.“

Meanwhile, Wilkin keeps meeting more people with mixed incomes. “One of my buddies does live sound for multiple artists,” he says. “He told me he got hired for one gig in 2019 where the band paid him on a W-2. ‘It was $5,000. That doesn’t represent my income at all. What do I do?’”

“I said, ‘the way the system’s set up right now, that’s all you’re gonna get noticed for,’” Wilkin continues. “‘All the other hard work that earned you money in 2019 is completely irrelevant.’”