On October 13th of last year, in Gettysburg, Pennsylvania, Donald Trump gave a desperate speech at a desperate moment. A week after the surfacing of the infamous “grab them by the pussy” video, Trump presented himself as the common man’s only defense against a vast conspiracy of global financial interests:

“There is nothing the political establishment will not do,” he said, “and no lie they will not tell, to hold on to their prestige and power at your expense.”

Including running Donald Trump as an anti-corruption candidate! He went on:

“For those who control the levers of power in Washington, and for the global special interests they partner with, our campaign represents an existential threat,” Trump said. “It’s a global power structure that is responsible for the economic decisions that have robbed our working class … and put that money into the pockets of a handful of large corporations and political entities.”

In conjunction with this speech, which was sold as the “crossroads of history” address (and triggered a new hashtag, #TrumpTheEstablishment), Trump released a 100-day “action plan” that supposedly targeted “special interest corruption.”

Among the measures proposed: new restrictions on lobbying, including a five-year ban on White House and congressional officials becoming lobbyists after leaving office.

Months later, with the self-proclaimed “existential threat” to special interests in office, the “establishment” has it better than ever. Not only has the money-over-principle dynamic not changed inside the Beltway, it’s ascendant. Under “outsider” rule, Washington has never been more Washington-y.

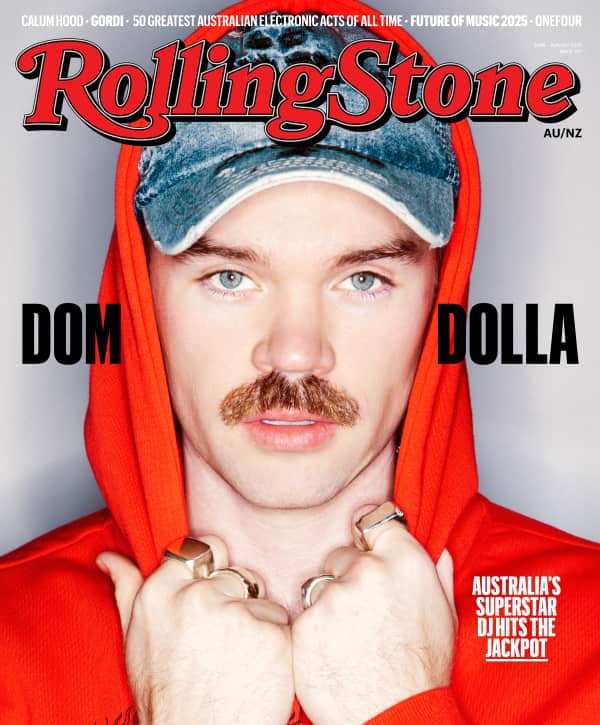

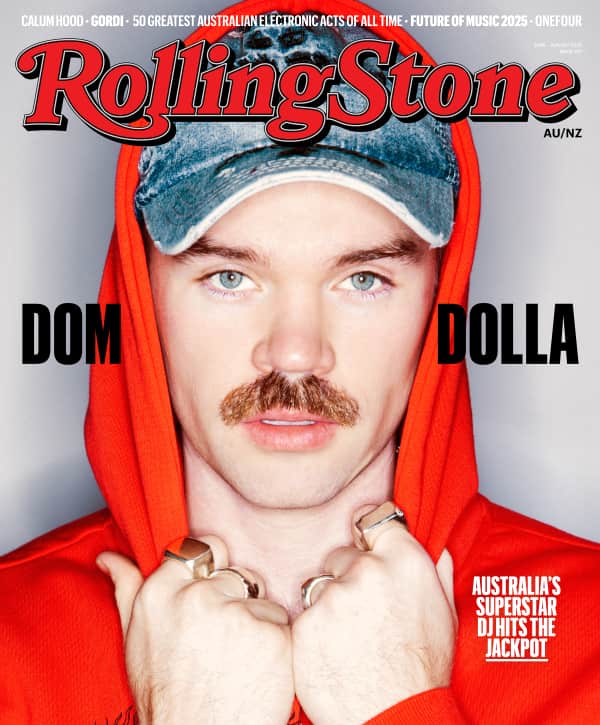

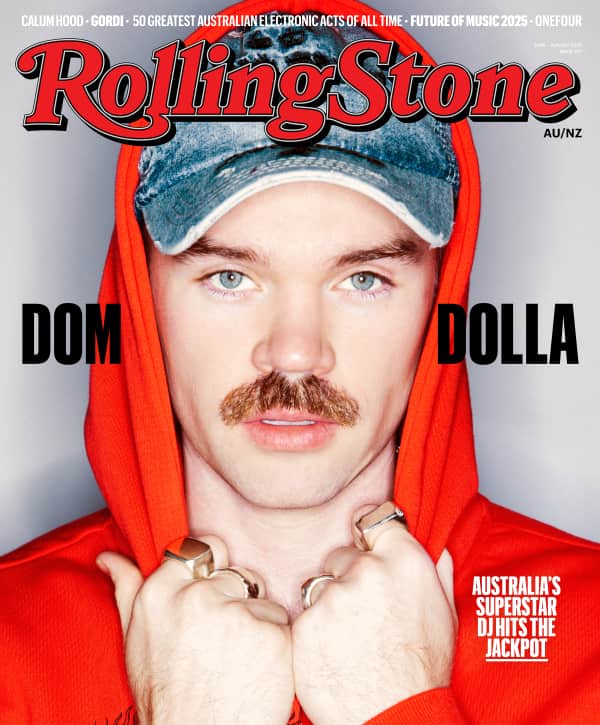

Love Music?

Get your daily dose of everything happening in Australian/New Zealand music and globally.

Tuesday, for instance, Trump signed a repeal of a bipartisan provision of the Dodd-Frank bill known as the Cardin-Lugar Amendment. The absurd history of this doomed provision stands as a perfect microcosm of how Washington works, or doesn’t work, as it were.

The election of a billionaire president who killed the anti-corruption measure off is only the brutal coup de grace. The rule was stalled for the better part of six years by a relentless and exhausting parade of lobbyists, lawyers and other assorted Beltway malingerers. It then lived out of the womb for a few sad months before Trump smothered it this week.

Section 1504 of the Dodd-Frank Act was created by Maryland Democrat Ben Cardin and then Indiana Sen. Richard Lugar. Passed in 2010, the rule was simple: It required oil, gas and mining companies to disclose any payments above $100,000 made to foreign governments.

The law was designed to prevent energy companies from bribing foreign dictators. The simple goal was to ensure that the wealth of resource-rich countries would be enjoyed by their citizens, and not converted into obscene personal collections of yachts, mansions, sports cars and Michael Jackson memorabilia – as, for instance, it was when oil was discovered in Equatorial Guinea, and the brutal dictator Teodoro Obiang started doing business with Rex Tillerson’s ExxonMobil.

The provision originally passed in the summer of 2010 and became law when Dodd-Frank was signed later that year. But it didn’t go into effect right away. As hotshot Wall Street lobbyist Scott Talbott of the Financial Services Roundtable cracked, “When [Obama] signed the financial reform law, that was halftime.”

After passage, the law went back to the SEC for the rule-writing process, where it spent two years being bandied around while special interest groups harangued the agency with suggestions and comment letters.

Those first years of SEC rule-writing included multiple meetings and rule addendum suggestions from trade groups like the American Petroleum Institute (API), as well as with executives from companies like ExxonMobil. (Exxon VP Pat Mulva and Corporate Securities and Finance Coordinator Brian Malnak met with the SEC twice in November of 2010.)

Then, on August 22nd, 2012, a version of the rule passed the commission by a vote of 2-1. Success! Yet shortly after the rule passed – on October 10th, 2012, to be exact – the aforementioned API, along with the Chamber of Commerce, filed a lawsuit against the SEC to block the provision.

The suit charged that the SEC “failed to conduct an adequate cost-benefit analysis as required by law” (this was a trick used multiple times to block Dodd-Frank provisions) and that the agency “grossly misinterpreted its statutory mandate to make a ‘compilation’ of information available to the public.”

Obama signing Dodd-Frank on July 21st, 2010

Industry whined that the rule would prohibit deals in countries where local laws prohibited disclosure of such payments, and that it would force firms to “sell their assets … at fire sale prices.” The basic idea was that international capitalism would grind to a halt if they had to make public which dictator’s yachts they were buying, and for how much.

The legal Hail Mary worked, naturally, as such suits nearly always do in Washington, and the rule was struck down by a D.C. district court in 2013. The court ruling required the SEC to either write a new rule or come up with a new justification for the old one.

This commenced another years-long slog of meetings, letters and suggestions. The oil-and-gas people, of course, pretended the whole time that they didn’t want to killthe provision, exactly, just improve it.

“As we discussed,” the API wrote to the SEC on November 7th, 2013, “API strongly believes an effective and workable result can be achieved that accomplishes the transparency objectives of the statute while also protecting investors from significant harm.”

API then proceeded to offer 16 maddening pages of suggestions that would ostensibly improve the provision. The SEC would ultimately cave on a number of these industry requests, resulting in a rule that in the end was significantly more convoluted than the original version.

This is why laws like Dodd-Frank end up being unwieldy monstrosities of thousands and thousands of pages: On the road to trying to kill a law outright, lobbyists usually try to weigh it down first by adding exceptions and verbiage. Ironically, this ends up driving the industry’s own compliance costs higher in the meantime, but it’s worth it, as it stalls the process.

Another irony here is that the public perception that nothing ever gets done in Washington is driven by this very dynamic. The public becomes impatient for action when every tiny provision of every bill gets bogged down as fat-cat lawyers fight for years on end over the definition of words like “compilation” and “project.”

This is the ultimate in overpaid busywork for the overeducated. The ongoing bureaucratisation of the legislative process is really just a high-priced welfare program for corporate lawyers.

And while lawyers make fortunes pushing commas around and adding mountains of words to already overwritten laws, ex-middle-class workers in places outside of the Beltway keep finding their slice of the pie smaller and smaller.

This leads to frustration with Washington inaction. And as we’ve seen, this leads to political support for big talkers like Trump who promise, hilariously, to cut through the red tape and “get things done.”

To make a long story short, the Cardin-Lugar provision ended up being delayed time and time again. At one point, the SEC had be kicked into action by Oxfam, which sued the agency essentially to force it to complete the rule.

Only after settling with the human rights organisation (like many human rights advocates, Oxfam’s interest here was in preventing bribes to repressive regimes) did the SEC finally go back to completing its court-ordered and congressionally mandated work.

Despite all of the delays and wrangling, however, it did finally pass last June. But in yet another lurid example of how idiotic our system is, the provision was upended by an asinine law called the Congressional Review Act.

This obscure Gingrich-era statute (signed into law by Bill Clinton), which seems to exist entirely for the purpose of allowing newly elected officials to overturn the work of their predecessors, permits the government to reconsider any piece of legislation within a window of 60 session days after implementation.

The CRA mechanism was put to use shortly after Trump’s inauguration. There were a few hours of debate in the Senate, a brief debate in the House, and then Cardin-Lugar was “executed at dawn,” as the Lugar Center put it, in an unusual early-morning Senate session that began at 6:30 a.m. on February 3rd.

“Congress,” the center noted, “took fewer than five days from the beginning of the legislative process to the end.” There were no subcommittee reviews, no hearings, nothing. After six gruelling years being pushed uphill, in a process that cost God knows how much in billable hours, the rule was scuttled in Congress and sent to Trump’s desk to be wiped out in a matter of weeks.

Ask Trump supporters about this episode, and many would say they won’t weep for the loss of any government regulation.

But they should ask themselves if, when they were whooping and hollering for the man who promised to end special interest and lobbyist rules in Washington, they imagined the ExxonMobil chief in charge of the State Department cheering as the new president wiped out anti-bribery laws. The “establishment” sure is on the run, isn’t it?