Bank Australia has committed to achieving net zero emissions across its operations, and its lending and investment portfolio by 2035. Here’s how the bank plans to achieve it.

Over the past few years, there’s been a lot of talk about 2050. Big corporations and governments have been using 2050 as somewhat of a yardstick: “We’ll get our acts together and definitely stop those nasty emissions by 2050, right guys?”

But in order to turn this ship around and actually save the planet, climate action — ceasing the use of fossil fuels — needs to be taken much sooner. 2050 is too late. We need to start cutting emissions now.

Bank Australia knows what’s what. It knows climate change is the defining issue of our time, and immediate action is required. Which is why it has committed to achieving net zero emissions across its business by 2035.

“Our 2035 net zero target is the most ambitious of any bank in the country and makes Bank Australia one of the most ambitious banks globally,” explains Bank Australia’s Managing Director Damien Walsh. “We hope our stance encourages other banks and financial institutions to accelerate their climate objectives as well.”

So how is Bank Australia going to do it? Here are just some of its plans.

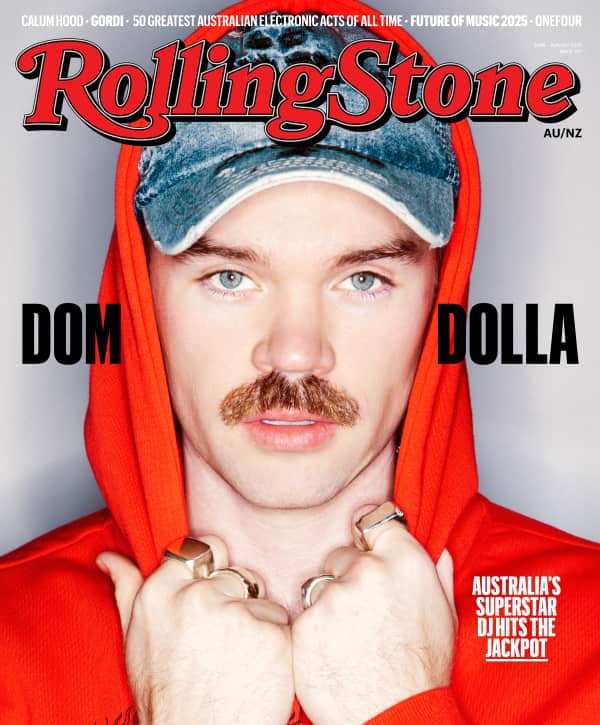

View this post on InstagramLove Music?

Get your daily dose of everything happening in Australian/New Zealand music and globally.

Most of its emissions come from the bank’s lending portfolio (that’s the loans it provides to build and buy homes), so it will be working with customers to help them reduce their emissions from electricity and gas use.

“We know that to achieve net zero, we’ll need to work in partnership with our customers to reduce their emissions and advocate for rapid electrification of Australian homes,” Damien says.

Bank Australia has been using 100% renewable electricity since 2019; it has already switched its fleet cars to hybrid. The next step is shifting its buildings and branches off gas, and helping bank staff reduce their emissions when commuting to and from work.

While the bank has long been funding registered carbon offset projects, its 2035 strategy will see it explore direct investments in projects that draw down emissions. It’s starting by looking into opportunities on its Salvana conservation reserve (which, by the way, is part-owned by every single Bank Australia customer).

Western District wind turbines, Victoria

Numerous fantastic initiatives are planned for the conservation reserve, particularly around resilience. The bank is working on a direct seeding project, which includes developing a climate-adjusted seed provenance collection, and sourcing seeds from hotter and drier, and cooler and wetter locations to plant in the reserve in years ahead. Land conservation is such an important part of protecting the environment, and the team hopes to share its learnings with other Australian landholders to show them what’s possible too.

Of course, climate change isn’t just about reducing emissions. It’s about justice too. Bank Australia recognises that First Nations voices must be heard first and foremost on climate action. It’s working with Barengi Gadjin Land Council to implement Indigenous land management practices at the conservation reserve; after all, it’s Indigenous land management that’s kept this country growing for tens of thousands of years, and this knowledge is essential to addressing the climate crisis.

“These targets are bold,” Damien admits. “We don’t yet have all the answers on how we’re going to achieve them, but we’re committed to working hard and being transparent about our progress.”