In the summer of 2021, I stumbled onto the world cryptocurrency by accident. A friend of mine encouraged me to buy some Bitcoin at the height of the mania, and to be honest, I was tempted. According to media reports, a lot of knuckleheads seemed to be getting rich off these cryptos, whatever the hell they were. I had never paid them much mind before, but I have a degree in economics and these things sure didn’t act like currencies as I understood them. That piqued my interest. It was also Covid and I was bored. Showbiz was more or less on ice at the time. What the hell, I figured, I’ll take a brief look at this crypto nonsense.

Two years later, the book I’ve written with journalist Jacob Silverman, Easy Money, is on sale tomorrow. It’s been a helluva adventure. I’ve interviewed everyone from average-joe traders to the now-indicted Sam Bankman-Fried himself. I went to El Salvador, the only country in the world trying to use crypto as real money (not working, shocker). I even ended up testifying to Congress as to my findings.

But my journey into the field actually began in my hometown of Austin, Texas. There, we got drunk with CIA bros and I interviewed Alex Mashinsky, CEO of Celsius, a crypto lending firm. You may have heard of him, he’s been in the news recently. See how it all went down in this excerpt from Easy Money.

THERE’S A COUNTRY SONG in here somewhere, but my journey from pretend journalist to pretend author started as it should have, at the beginning. In early 2022, South by Southwest, a big tech and music conference in my hometown of Austin, Texas, invited me to organize a panel of crypto skeptics. I was pretty fired up. SXSW would mark our first venture into the real world; everything Jacob and I had done thus far was online or remote. We recruited Edward Ongweso Jr., a razor-sharp journalist for Motherboard, Vice’s technology site, to join us on stage. I decided to record the whole thing, hiring a local director of photography, Ryan Youngblood, to film whatever hijinks might transpire. Maybe I’d stumble into something newsworthy.

My parents still lived in Austin, and the allure of free babysitting was strong. I decided to take my six-year-old daughter, Frances, along for the ride. She’d been hearing a lot about Daddy’s weird foray into cryptocurrency; now she would have the opportunity to see me in action. And with that, our motley crew SXSW dream team had been assembled: three journalists, a cameraman, and a six-year-old who couldn’t care less about cryptocurrency.

In typical Austin fashion, we were ready for things to get weird. But we couldn’t anticipate quite how weird they would get.

OUR FIRST EVER IN-PERSON journalist outing — a SXSW blockchain schmooze-fest — turned out to be one of the strangest. Having just picked up our press passes, Jacob, Ryan, and I strolled into a bar that had been converted into a demo space for Blockchain Creative Labs, the new crypto venture from Fox Entertainment. Immediately a few ironies presented themselves. Blockchain was supposed to overthrow the old techno-economic order and yet here was one of the country’s most powerful media conglomerates leading the supposed revolution. The decentralized and democratized future of finance, brought to you by Lachlan Murdoch. Interestingly, much of my TV career was spent under the Fox umbrella (The O.C. and Gotham ran on their channel in the United States), so I knew some of the publicity people at the event. But this time, we weren’t necessarily working toward the same ends.

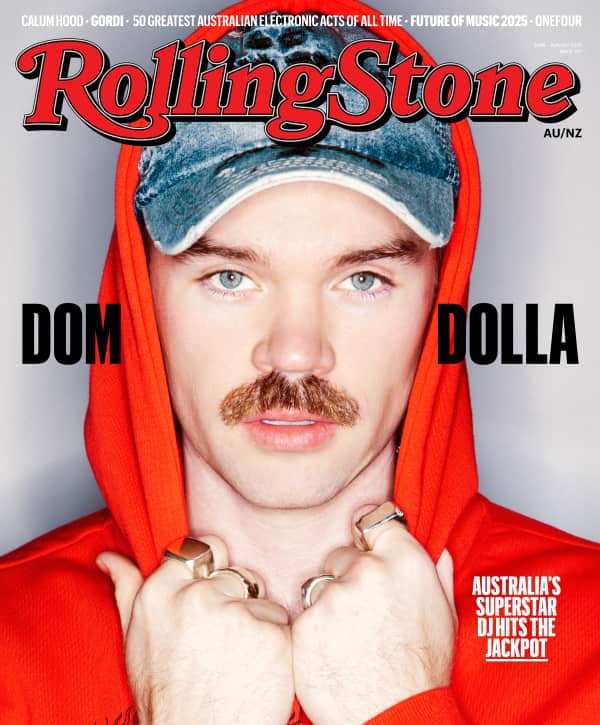

Love Music?

Get your daily dose of everything happening in Australian/New Zealand music and globally.

We were greeted by eight-foot-tall animations of the wrestler “Stone Cold” Steve Austin, which, through the miracles of corporate branding partnerships, were now available as NFTs. The place was littered with massive screens tuned to maximum brightness, strobing through various NFTs of Fox-owned intellectual property — wrestling and cartoons were heavily featured — that were being monetized under the Blockchain Creative Labs brand.

The plain absurdity of the situation was immediately clear. Could this garish display of crypto novelties really be the next frontier of entertainment? Would consumers really want to buy and sell their own unique receipts for individual episodes of sitcoms stored on blockchains?

The crowd was a mix of techie true believers, digital artists in search of a business model, and corporate profiteers. We tried to approach people where they were at, asking why they believed in this stuff so much, and why some of them were willing to take such extreme financial risks. One man told us that he belonged to at least four DAOs — decentralized autonomous organizations — from which he earned several different cryptocurrencies. A DAO starts with a loose group of people who share a common goal. They build (or attempt to build) an organization without a central authority, instead relying on a set of rules, otherwise known as a protocol, run through automated computer programs called smart contracts and stored on ledgers called blockchains. Membership in the organization is denoted in a governance token, aka a cryptocurrency, which is sort of like a voting share of a stock. If it all sounds painfully complicated, it’s not you. DAOs are notoriously unorganized, and prone to hacks and scams. Again, someone has to write the code on which they are based, and this exposes the members of DAOs to a lot of risk. We mentioned this to the gentleman we were interviewing; it seemed more than a touch reckless to have nearly all of one’s income and net worth in volatile crypto tokens. We asked how he juggled all of the different digital currencies. “Well, there’s another DAO that helps with that,” he said. His dream was to move to Portugal, a burgeoning crypto tax haven.

Nearly everyone we interviewed had been scammed. When asked, most admitted it quite readily. It was, if not a rite of passage, then an accepted cost of entry to an unfettered market defined by financial freedom. Bad actors are everywhere — certainly in so-called TradFi, or traditional finance — so why should crypto be different? The rationalizations piled on top of one another until it was, at times, hard to see what was so appealing about a new monetary system in which having something stolen from you, with no insurance, no possibility of restitution, much less accountability, was expected. Worse, folks tended to blame themselves for being scammed. They hadn’t educated themselves about security, they said, or they clicked something they shouldn’t have, or their greed got the better of them and they were convinced to hand over a small piece of information that they didn’t realize would leave their digital assets exposed.

It had all become so deeply internalized, forming a fundamental part of crypto culture. There was rarely anger directed toward the scammers themselves. (Occasionally there was admiration for their skill and boldness.) DYOR. It doesn’t matter if crypto, from the executive-level bloviating to the bullshit hype on social media, was riven with misinformation and outright lies. You got scammed? You fucked up. DYOR next time, man. And welcome to the club.

It sounded like a cult, I said to the DAO guy. There was a certain shared form of understanding, a sense of value, that appealed only to people in the in-group. He laughed and shrugged. Well, yeah.

Later we met a sweet, earnest man in his thirties named Marcel, a digital artist and UX designer whose colorful asymmetric haircut and fluency in the economics of web3 made him far hipper than me. Asked if he worked at SXSW, he shook his head. “I just like helping onboard people to blockchain stuff.” Marcel traded NFTs of his own art with friends he met online and was increasingly excited by the possibilities of NFTs in gaming, where elaborate NFT- and token-based economies would allow someone to, say, make small bits of digital money by flying an F-16 in a video game. It seemed like a rather banal and not very tech-forward future — something that would inevitably be dominated by veritable sweatshops of poorly paid Southeast Asian laborers tapping away on apps for distant western clients. (At the time, the big player in this growing “play-to-earn” space was Axie Infinity, which was made by a Vietnamese gaming company whose player base was concentrated in the Philippines. It would get hacked on March 23, the week after SXSW ended, for $620 million worth of crypto.)

We excused ourselves from Marcel and the strobing NFT displays and sought refuge at the bar. Refreshing ourselves with cold beers, we took a few deep breaths and contemplated our next move. I felt eyes on the back of my head. I turned to find a tall, broad-chested man in his late forties standing just a few feet away, staring at me in the awkward way I had grown somewhat accustomed to as a celebrity. I braced myself for the “Do I know you from somewhere?” or “Are you that guy from TV?” but what actually came out of his mouth was:

“I’m with the government. Can we talk for a moment?” Sure, we said, immediately thrown.

“Are you all American citizens?” Yes, we said.

“I’m with the CIA. Sometimes we work with prominent people and celebrities, like you.”

The guy who had approached us, whom I will call Charles, led us over to a group of six people with SXSW name tags that read USG in the spot reserved for their employer. Most of them were unassuming: close-cropped hair, dress shirts, fleece vests — the typical uniform of law enforcement people playing at casual dress. We made a peculiar form of small talk. Just one of the supposed CIA officers had long unkempt hair; he claimed to work on cartels. He said that while crypto was being used by the bad guys for money laundering, he had also found it useful to pay informants. Easy to move across borders. All of them claimed to have some reason to be at the conference — an interest in new technologies or to keep an eye on important political or tech figures with the usual suspect associations: Russia, China, Iran, North Korea. In 2022, Ukraine was also on the list.

Someone handed Jacob a business card that identified himself as part of an interagency task force based in Austin. Other cards and affiliations passed back and forth. We had no idea if any of it was real. Charles said we should continue the conversation. He asked what we were up to that night.

We stumbled out of the party and back into daylight. “What the fuck was that?” asked Jacob.

“The CIA wants to take us to dinner,” I said. “Are we? Are they?”

“Of course.”

I was pretty new to the profession, but I was fairly sure a cardinal rule of journalism was that whenever the CIA invited you to dinner, you said yes. Not because you were susceptible to their pitch, mind you, but isn’t your primary job as a reporter to seek the truth, to wheedle it out of sources and then fashion it into a compelling story? My moonlighting gig as a member of the fourth estate had already brought me into some strange rooms with some decidedly strange people. To that point, most of it had come virtually, in the form of Zoom calls with off-the-record sources, private exchanges with self-proclaimed whistleblowers, various social media DM groupings, and chat rooms with people posting under pseudonyms. Its many charms aside, the digital world of crypto gossip and information-trading couldn’t hold a candle to the meatspace environment we had somehow found ourselves in. Reporting from our very first in-person event, we had been approached by intelligence operatives with some bizarre interest in us. It was clear there was no choice in the matter. We were going to dinner.

Forget the metaverse; the physical world was a trip, man.

THAT NIGHT WE SAT DOWN with Charles and his friend Paul at one of the city’s better steak houses. Martinis appeared with regularity. No one mentioned the evening being off-the-record, but when Jacob made reference to his work, Charles cut him off. “No, no. If I’m meeting with a journalist I have to report it. Be something else.”

Jacob told him he was shopping a novel to publishers. “Great! You’re a novelist tonight.”

There was no debate over what I was to be classified as. I tried not to take it personally.

The exchange practically repeated itself verbatim later in the evening, but somehow we contorted facts to obscure what was obvious: Jacob was a journalist, I was at least playing one, and we, of course, were going to write about all of this.

It was all really weird. Charles and Paul seemed far too solicitous and far too revealing in what they said and how they acted. They also seemed to know almost nothing about crypto. Every story we told them, even the most well-established tales of corporate malfeasance, was greeted with what might have been mock astonishment. They had no idea it was so bad, they said. Perhaps we should talk to some of their colleagues at the FBI?

Gee, guys. Sure.

Charles was a couple years from early retirement. “I can’t wait to smoke weed!” he said.

“It’s great,” we assured him.

All evening, Charles cited regulations — no dinners with journalists being among the most obvious — while also flouting them. He made a joke about his next polygraph, maybe his last, being a ways off.

Two-pound lamb chops, bathed in sweet marinade, were slapped down on the table. Thick creamy potatoes au gratin, a polite helping of asparagus, more martinis to wash it down.

Charles and Paul sketched out their résumés. Charles claimed to be a case officer who worked in various global hotspots and world capitals recruiting covert sources. Paul appeared more polished, at least at first, ticking off stints at West Point, Delta Force, NSA, then onto the private sector, working for major tech and consulting firms. He spoke three languages and saw action in an equal number of undeclared wars. Asked if he was still in the intelligence world, Paul laughed. “There’s a dotted line,” he said.

After initially coming across as more reserved, Paul was soon talking about his divorce and his kids and the personal trainer he had recently broken up with. He flashed us a photo of a pretty blonde on his phone. “I couldn’t deal with her anymore.”

It sounded, quite frankly, insane — something out of a movie that I had no interest in starring in.

I had been waiting all night for a specific ask and never quite got one. Charles elaborated on what he had said when he approached me that afternoon. Sometimes the intelligence community works with famous or prominent people to broker introductions to people of interest. Imagine if I were at some rich person’s soiree talking to a Chinese tech CEO. Suddenly, my friend Charles walks by, and I do the “Have you two met?” routine. Or so it went in theory.

Would that actually happen? And why would I want to do it? It sounded, quite frankly, insane — something out of a movie that I had no interest in starring in. Charles asked if I had ties to the area. I said I was from Austin. No, some way I could prove a connection there, he said. I told him I owned a piece of real estate in a nearby city. Perfect! Since he was based in Austin, he could be, well, my handler, checking on me when I passed through town. This was not the sort of check-in I wanted when I brought the kids to visit their grandparents.

Charles and Paul couldn’t help themselves and were breaking their own rules all night. Or perhaps that was part of the game. It was hard to know what to attribute to incompetence plus male bravado plus alcohol and what to attribute to the clever dissembling of trained liars, as most spies are (but perhaps not these two).

More than one story shared that night involved either Charles or Paul saying something like, “Well should I . . .” or, “Maybe I’ve gone too far, shit how do I say this part . . .”—before inevitably continuing to dish. There were a couple allusions to a “home run,” some recruitment or inroad made with someone visiting for the festival. For someone now ostensibly working in the private sector, Paul was clearly wired into what Charles and his team were doing. They shared a familiar shorthand—the nicknames for old colleagues, two-word references to past glories.

It went like this all night, Jacob and I exchanging occasional looks that indicated our mutual disbelief. At one point, Jacob gawked as Charles explained that the NSA had found “a small bug” in Signal—the encrypted messaging app used by journalists, activists, and millions of other people, including the spies at our dinner table—but if you restart your phone once a week or so, it wasn’t a problem. It was hardly a sophisticated technical explanation, and maybe it was all bullshit braggadocio, but a Signal exploit would be incredibly valuable—easily seven figures on the open market—and a closely held secret by any intelligence agency.

None of it made much sense. They seemed to know nothing about crypto, blockchain, or the fraudulence and criminality that we claimed undergirded the industry. Why were two guys who expressed such ignorance about our core concerns recruiting us? Were we being had?

As the bill for our lavish, boozy dinner came—paid for by Charles, which is to say, by you and me, fellow taxpayer—it was clear that our new friends weren’t ready to go home. They asked us what was next. More drinking was the obvious answer.

At a bar on Rainey Street that had been converted to a branded garish party house for CNN+, the lavishly advertised streaming venture that would shut down six weeks later after having squandered $300 million, a chipper young woman greeted me as soon as our group entered. “Ben, so glad you’re here! Please come with me.”

Our group of six-plus dudes, most of them not quite the smooth club- going type, was escorted through the bar, a former single-family home, into the backyard, where we sat on couches behind a gray velvet rope. It was a bit of a flashback to my twenties, when I shamelessly surfed the Hollywood club scene like other suddenly famous teen idols. Now, cowed by experience and happily domesticated in my forties, I wasn’t sure what to make of it, the pageantry and the looks from other partygoers. We eyed the open bar—those being two of the deadliest words in the English language—with short-lived suspicion, then thirst.

We all drank more, toasting to . . . something? Maybe blockchain. Iron- ically. At a certain point, Charles got up and said, “I want to give you guys something.” Then, in a series of too obvious exchanges, again like we were parodying a spy flick, he shook hands with me, Jacob, and Ryan, giving each of us a CIA challenge coin, a marker of accomplishment for law enforcement officers and sometimes a kitschy souvenir for people they’re trying to flatter. In our case, it was obviously the latter. On one side of the thick coin was the CIA emblem and on the other a U-2 spy plane with the words “In God We Trust, All Others We Monitor.” We put them in our pockets.

THE NEXT MORNING, my head reeling from our night with the spooks, I stumbled out of bed and managed to make my way to the Austin Convention Center to meet Jacob and Ryan. The day before, when sober, we had made a loose plan to meet up before our panel later that afternoon, figuring we could fill time by conducting a few impromptu interviews with average crypto enthusiasts before the main event. Jacob was running late, so Ryan and I decided to head to the convention floor to check out the various companies shilling their digital wares.

As we entered the exhibition hall, the first corporate booth I saw made me laugh with disbelief. I knew the company, and not in a good way. Turn- ing around, I recognized a man I was deeply familiar with from our online sleuthing. My pulse quickened. As I stared in disbelief, Jacob arrived.

“We need to talk to a lawyer,” he said. He was thinking about the CIA and that weird approach, but my mind was elsewhere.

“Yes, but never mind that now,” I said. “First — and don’t look — I need to tell you who’s sitting on a couch about twenty feet behind you. Alex Mashinsky.” In the last few years, the crypto economy has become much more complicated than enthusiasts buying and selling a handful of popular cryptocurrencies.

There are more than 20,000 cryptocurrencies out there, sophisticated exchanges, decentralized finance protocols that allow billions of dollars of crypto to change hands without human intermediaries, and financial products that resemble less regulated, riskier versions of their Wall Street equivalents. At least in the gambling-like realm of financial speculation, there’s a lot you can do with crypto. With few guardrails in place, it’s easy to borrow money and add leverage in order to increase one’s odds of winning big or losing everything. Many of these financial products and transactions are extremely complicated, and difficult for the average investor to navigate. Nearly all of them are extraordinarily risky.

To guide consumers through this world of high leverage and wild speculation, a new generation of supposedly bank-like entities appeared. They took your crypto and managed it, with a typical offering allowing customers to “stake” their tokens for extraordinarily high interest returns — think 10 percent or more, sometimes much more. And with your crypto, they made their own bets and loans and investments, acting at once like a bank and a hedge fund. The problem was that crypto was extraordinarily volatile, with no inherent value, and that these banks (or bank-ish entities) might have been engaging in the kind of Ponzi economics that seemed to animate much of the crypto world. Many of these companies had also received scrutiny from the SEC and other regulators.

Gall was in abundant supply in the risk-tolerant world of crypto.

So it was a bit of a surprise for me to walk into the main convention hall at SXSW and find myself staring at a booth for Celsius, one of the biggest crypto “banks” out there, at one time claiming somewhere around $20 billion of crypto assets under management. By some measures, Celsius was a successful going concern, but with investment backing from Tether (they loaned Celsius over $1 billion), strange lending activities, sky-high interest rates on offer, and some murky movement of its tokens, it was an object of extreme speculation and rumor within the crypto-skeptic world. Many people suspected that it was yet another Ponzi scheme. Some government agencies shared those suspicions, with Celsius facing legal action in multiple states: New Jersey, Alabama, and even Texas. To set up a promo stand in a state where your company was currently embroiled in litigation against that state took a certain kind of gall.

But gall was in abundant supply in the risk-tolerant world of crypto. Alex Mashinsky, the CEO of Celsius, wasn’t immune to this kind of hubris. Celsius’s chief financial officer had been arrested in Israel in November 2021 on charges of fraud, but Mashinsky refused to even discuss the issue publicly. Instead, he continued to tout the Celsius brand on Twitter, at conventions, and across crypto media. Angrily denying the rumors swirling through crypto Twitter, Mashinsky held regular Ask Me Anything sessions on Twitter Spaces — events celebrating the Celsius “community” and its growing wealth. At SXSW, Mashinsky was in his element. His booth, a garish mix of off-white and purple paneling, touted the company as the obvious partner for consumers looking to escape the tyranny of TradFi banking. The typically voluble Mashinsky sat kibitzing with cofounder and Chief Technology Officer Nuke Goldstein and Chief Growth and Product Officer Tushar Nadkarni on some white leather couches nearby.

Despite my nerves, I had to talk to him. I felt the same performance jitters I’d felt before going onstage on Broadway just two years prior.

I wired up and quickly rehearsed some points of inquiry with Jacob — Celsius’s relationship with Tether, its legal problems, its improbably high yield rates, its executives’ apparent connections to Israeli money launderers, and maybe whether it all was a giant Ponzi scheme. Jacob and our friend, the journalist Ed Ongweso Jr., slunk off to the corner, sitting in a couple chairs obscured by large plants from where they could monitor the scene and take some cell phone videos. It was comically cloak-and-dagger, more Pink Panther than All the President’s Men, but that was becoming the dominant tone of our investigation.

I took a breath, told myself that I wasn’t hungover from a night of drinking with CIA operatives, and, trailed by my cameraman, did my most confident walk over to Mashinsky and his confederates.

“Hi, Alex. My name’s Ben.”

“Hey! Didn’t I meet you in Vegas?”

I hadn’t been to Vegas in at least a decade.

“Sure, yeah! Must have been. Anyway, I’m an actor and I’m writing a book about cryptocurrency now. I’ve got my buddy Ryan here and I was just wondering if we could do a little interview on camera about crypto and your company.”

For reasons that can only be attributed to ego, Alex Mashinsky said yes. So we talked: about an industry rife with speculation, about Celsius’s relationship with Tether (he downplayed it), about risk, about the supposed promise of crypto. As the conversation went on, several Celsius staffers, all of them young women, circled the couches, alternating between punching away at their phones and staring at their free-talking CEO with growing concern. At one point, Mashinsky’s wife Krissy, decked out in a pink Juicy Couture velour jumpsuit, stood directly across from him, giving him a death stare. The point was clear: End the fucking interview! But Mashinsky brushed her off with a wave of his hand. We got it on camera. There were moments that astonished me. Talking about scams, he took the usual tack and said people needed to educate them- selves. Alas, there are a lot of scammers out there, but always DYOR. I asked him, didn’t that really mean it’s the customer’s fault? Most crypto CEOs duck that question, or pretend to be offended. Instead, Mashinsky leaned back and said, with a “Who me?” kind of mock innocence, “If you left money on the street, you[’d] expect it to be there in the morning?”

Toward the end of our conversation, when the video was off but with audio still rolling, Mashinsky told me something that made my blood run cold. I asked him how much “real money” he thought was in the crypto system. I didn’t think he would actually answer the question, but he did.

“Ten to fifteen percent,” Mashinsky said. That’s real money — genuine government-backed currency — that’s entered the system. “Everything else is just bubble.”

The number seemed straightforward and eminently believable. But it was still shocking to hear it from a high-level crypto executive, who seemed totally unconcerned about it all. Mashinsky acknowledged that a huge speculative bubble had formed. If the overall crypto market cap was about $1.8 trillion at the time we spoke, that meant that one and a half trillion or more of that supposed value didn’t exist. And given the general lack of liquidity in crypto markets — that a billion dollars’ worth of Ethereum isn’t redeemable for a billion dollars of cash without tanking the market — that meant that the crypto economy was dancing on a knife’s edge. One bad move by a major player might tip the industry into freefall. An illiquid market based on irrational speculation, it was all essentially vapor. Crypto critics call it “hopium,” and it’s a powerful drug. People thought they had money, something of value, and yet they didn’t. They would never get their money back, because it wasn’t there. It existed in the form of rapidly depreciating tokens or had already been shuffled between a dozen offshore corporations. As OG crypto critic David Gerard would say, “You lost your money when you bought the tokens.”

Alex Mashinsky didn’t have to ask what I meant when I talked about “real money” in the system. He had an answer ready. Was he that deeply cynical about the industry, or was he just another profiteer squeezing out whatever value he could before the crypto market fell back to earth, leaving behind a crater filled with ruined investors?

***

Celsius declared bankruptcy on July 13, 2022. Alex Mashinsky is currently being sued by the New York Attorney General for fraud. Last Thursday, he was arrested and charged by the SDNY with fraud. He has pleaded not guilty. Simultaneously, he is being sued by the SEC and CFTC for similar alleged crimes. He has pleaded not guilty to the criminal charges, and denied all other allegations.

Excerpt from the upcoming book Easy Money: Cryptocurrency, Casino Capitalism, and the Golden Age of Fraud by Ben McKenzie with Jacob Silverman published by Abrams Press, Available July 18

Text copyright © 2023 Benjamin Schenkkan

From Rolling Stone US